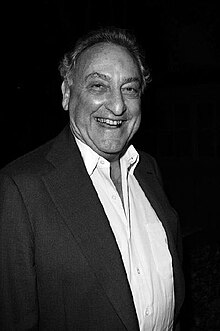

Sanford I. Weill (1933 – present) pictured in 2009 at Metropolitan Opera

Witness Post: Sandy Weill

The way that Sandy Weill explains his life on Wall Street during his tenure at American Express and after is both short and concise. The versions I have heard and read, however, are different. This Witness Post focuses on Weill’s departure from American Express and his re-ascendance story at Commercial Credit Corp. in 1986. The Post offers scant background and business references because the “public stories” and accolades for Weill are vast and unbiquitous. Since this particular story occurred 38 years ago (writing now in 2024), it seems natural that Weill would exaggerate what happened, abbreviate the journey and shower himself with brilliance. While his life before and after AMEX may have had many flashes of insight, this time period deserves a closer look. Below are some notes that tell a variation of the Weill story starting with his time at American Express and next at Commercial Credit.

In 2011, Weill said in an interview for the Gerald R. Ford Oral History Project [1]:

“My company evolved over time where former President Ford came on the board of Shearson Loeb Rhoades in the latter part of 1980. In 1981 we sold our company to American Express. A year later Ford went on the American Express board, which he stayed on for the next twenty-some odd years.

I left American Express and started a new company called Commercial Credit in ’86, which in 1998 became Citigroup. So he [Ford] was on the board of Commercial Credit, which through its name change to Primerica, through its name change to Travelers, to its name change to Citigroup. And he stayed on that [board] until a couple of years ago.“

The dozen years of Weill’s empire building (CCC to Citigroup) are nothing short of brilliant. Yet the version I heard of those formative years was quite different and much more nuanced:

According to the New York Times, Weill was extremely frustrated in his final years at American Express. He resigned after engaging in a final disagreement with CEO, Jim Robinson, and other executives at the company. Upon his resignation, Robinson quickly replaced Weill with an internal candidate, Louis V. Gerstner Jr., head of travel services at American Express. The resignation came “after months of rumors that the strong-willed Weill, was restless in the huge company.” The NYT stated that “he made at least two unreported attempts to buy the troubled Fireman’s Fund Insurance Company, which he headed, from American Express.” [2]

According to the LA Times Weill’s tenure at American Express was complicated: “’It was a funny experience,’” said Weill, as he twirled his ubiquitous cigar with his fingers. “’I’d worked for American Express from the day we sold Shearson in 1981. But now I was doing my own thing, trying to get things together and make them work, thinking about the future, and I realized how happy I was.'”…According to the LA Times reporter, “Weill seemed relaxed as he talked about his attempt to organize a private buy-out of American Express’ troubled Fireman’s Fund unit.“

“His proposal was ultimately rejected by American Express, which triggered his decision to resign. But putting the offer together helped crystallize his feelings about what he didn’t like about working for American Express.”

“When the company acquired Shearson Loeb Rhoades, a firm Weill had built almost from scratch into the second largest on Wall Street, Weill hoped to run American Express someday. But Chief Executive James D. Robinson III, at 49, three years Weill’s junior, made it clear he had no intention of turning over the reins anytime soon. Weill found himself trapped as the company’s No. 2 with relatively little executive authority.”

“Word of Weill’s growing unhappiness began leaking out last year and speculation that he intended to leave became widespread when he sold most of the American Express stock he had received from the Shearson deal.“

“’The speculation helped cause what happened,’” Weill said. “’It created a sense of paranoia. Jim and I were good friends, but nobody believed we could get along from day one. I’d hear things about what Jim was supposed to be thinking, and it would make me nervous.‘”[3]

After resigning from American Express, Sandy Weill next attempted to become the CEO of Bank of America Corp, but in the contentious process, he was nominated, vetted and then rebuffed by the BofA Board. Weill, then 58, took some time off, licked his wounds and searched for his next purchase.

Commercial Credit Corp.

Despite his claims of origination, Sandy Weill did not start Commercial Credit Corp (CCC) in 1985. It had been alive and well in the insurance and financial leasing space in Baltimore, Maryland, since 1912. In 1985 CCC was owned by Control Data Corp. At that time computers were rapidly becoming less expensive and more powerful. Many of Control Data’s customers that had previously leased mainframes from Control Data began to buy their own computers and to service and maintain them in-house. As this trend intensified, Control Data no longer needed CCC to help with client leasing. Because of Control Data’s large losses in the computer business, CCC soon lost its investment-grade credit rating, forcing it to pay higher interest rates and a lot more cash for its borrowed money.

In late 1984 the parent company, Control Data Corp. tried to spin-off and sell CCC but found no financial takers. By 1985 the executives at CCC were forced to sell more of the company’s peripheral businesses in order to pay down its swelling debt load. Quickly thereafter, the company began regaining its health, earning about $80 million in 1985 on revenue of about $1.1 billion by year end. It had assets of $5 billion.

Robert O. Bonnell, Jr.

In 1986, CCC internally recruited Robert Bonnell, an experienced insurance executive with American Health & Life Insurance Company (owned by CCC), to take another run at separating CCC from Control Data Corp. Bonnell, a Naval Academy grad, concentrated his efforts on selling the enterprise to well known public company stewards. He spent a lot of time on the golf course pitching the company to wealthy prospects. In September 1986, with the encouragement and invitation of Bonnell, Sandy Weill took a hard look at Commercial Credit Corp. That autumn Weill agreed to step in and became chair and chief executive of CCC, still based in Baltimore. The marriage was quick as Weill met the challenge; he had been in search of a company to buy and wanted a finance and insurance platform to get back in the game: Bonnell presented the perfect launch pad. [4]

After intense negotiations, Weill and Bonnell convinced Minneapolis-based Control Data to reduce its stake in CCC to about 20%, while Weill and other CCC executives bought 10% of the privately held shares. The remaining 70% was later sold to investors in a public stock offering. The total out-of-pocket purchase price of CCC for Weill and his team? A mere $7 million.

Weill at the Helm of Commercial Credit

As the new captain of the Commercial Credit Corp., Weill promptly assembled a group of experienced finance executives. He paid them less than they had earned elsewhere on Wall Street, but he rewarded them handsomely with CCC stock. The new management team quickly went to work examining the vast collection of CCC finance and insurance businesses. The team took out a hatchet to some of the CCC divisions: they sold off the businesses in life insurance, vehicle leasing, and overseas lending. Within just one year, CCC management tripled its operating profits. In September 1987, using cash on the balance sheet, CCC bought back Control Data’s remaining stake for $22 per share.

In 1988 Weill used the rejuvenated Commercial Credit Corp. as a springboard to a shopping spree. CCC’s largest purchase that year was Primerica Corp, the parent company of Smith Barney and the A.L. Williams insurance company. To finance the deal, Primerica’s stockholders were offered CCC shares on a one-for-one trade basis. Because of a difference in dividend yields, Primerica holders were also offered a one-time $7.00 per share cash dividend. The total purchase price was $1.54 billion. Weill insisted on keeping operating control, so although Primerica owned 54% of the new company, they held only four of 15 seats on the board of directors. Technically, CCC was the buying company, however, the Primerica brand was kept as the name of the new company. In the deal CCC became a subsidiary, and it emerged as the leading component of Primerica’s consumer services division. Accounted for separately, CCC’s 1988 profits were $161.8 million on sales of $943.7 million for a 17% operating margin. Not bad for a price tag of $7 million.

By 1989 Primerica/CCC had 490 offices in 29 states and $3.4 billion in receivables. Weill continued to make changes to strengthen its financial performance, tightening underwriting criteria and monitoring loans through more sophisticated financial systems. Greater emphasis was placed on collecting loans and resolving problems. In April 1989, Primerica acquired Action Data Services, a data processing supplier. The transaction was partly for Primerica to perform in-house data processing. In late 1989 for a price tag of $1.35 billion, CCC acquired the branch offices and loan portfolio of Barclays American Financial. Barclays, based in Charlotte, North Carolina, was a branch of Britain’s Barclays Bank PLC that specialized in consumer loans and home equity lending.

From that point on, Weill’s mergers and acquisitions are nothing short of astonishing: In early 1989, Weill acquired all of Drexel Burnham Lamert’s retail brokerage outlets. In April he acquired Action Data Services, a data processing supplier. The transaction was partly for Primerica to perform in-house data processing. In late 1989, for a price tag of $1.35 billion, he bought the branch offices and loan portfolio of Barclays American Financial in Charlotte, North Carolina, which was a branch of Britain’s Barclays Bank PLC that specialized in consumer loans and home equity lending.

In 1991 he bought Landmark Financial Services Inc., the consumer finance branch of MNC Financial, for about $370 million. By the end of 1992 CCC/Primerica had 695 branch offices in 39 states and was planning to open 50 more offices during the next year. Newer offices were being opened with staffs of only two or three, versus four or five for older offices, and used one-third less space. These and other cost control efforts had brought operating expenses down to 4.28% of average receivables. The branch office network used a goal system that encouraged managers to treat their offices like their own businesses, giving them control over revenues and expenses. Because they were more aware of the conditions of a local economy, they were given flexibility in determining if customers met corporate credit requirements. Top performing managers were rewarded with large cash bonuses.

In 1992, Weill showed his familiarity with companies flailing from financial missteps. He agreed to pay $722 million to buy a 27% share of Travelers Insurance Corp., which had gotten into deep trouble with some bad real estate investments.

In 1993 Primerica introduced a new computer-based branch information system called Maestro. The system automated point-of-sale marketing and credit evaluations, allowing branches to quickly determine which products a given customer was qualified for. Prior to that time, customer data was written on forms and credit checks were done by telephone and through the mail.

The continued resurgence and dominance of Sandy Weill on Wall Street was profound. In 1993, in a fascinating turn of events, Weill reacquired his old Shearson brokerage firm (now Shearson Lehman) from his former employer, American Express, for a price of $1.2 billion. By the end of the year, he had completely taken over Travelers Corp. in a $4 billion stock deal. The combined conglomerate was officially named Travelers Group, Inc.

Traveler’s Group, Inc./Citigroup, Inc.

Because Weill believed that scale mattered in the insurance business, he continued his hunt for likely purchases. In 1996 he added the property and casualty operations of Aetna Life & Casualty to Traveler’s holdings at a cost of $4 billion. Continuing his buying spree, in September, 1997, Weill acquired Salomon Inc., the parent company of Salomon Brothers, Inc. for over $9 billion in stock. The new enterprise, a massive brokerage and insurance enterprise, was dubbed Citigroup, Inc. with Weill serving as Chief Executive and Board Chair. He served in those positions from 1998 until October 1, 2003, and April 18, 2006, respectively.

Sandy Weill — Background

Sanford I. Weill was born in Brooklyn, New York to Polish immigrants Etta (Kalika) and Max Weill. He attended P.S. 200 and Peekskill Military Academy in Peekskill, New York. He enrolled at Cornell University in Ithica, NY, where he was active in the Air Force ROTC and Alpha Epsilon Pi fraternity. Weill earned a BA in government in 1955.

Business Career

Weill, shortly after graduating from Cornell University, got his first job on Wall Street in 1955 – as a runner for Bear Stearns. In 1956, he earned his broker’s license and started pouring over company financial statements and public disclosures made to the SEC. For those first many weeks his only client was his mother, Etta, until his girlfriend, Joan, persuaded her ex-boyfriend to open a brokerage account with Weill at Bear Stearns. [5]

Building Shearson (1960–1981)

One of Weill’s neighbors was Arthur Carter, who worked at Lehman Brothers. Together with Roger Berlind and Peter Potoma, they formed Carter, Berlind, Potoma & Weill in 1960. Two years later the firm was renamed Carter, Berlind & Weill after the New York Stock Exchange brought disciplinary proceedings against Potoma. Six years later, Arthur Carter left the firm and it was renamed Cogan, Berlind, Weill & Levitt. Jokingly known on the street as “Corned Beef With Lettuce.” Weill served as the chairman from 1965 to 1984. During that time period, the firm completed 15 acquistions and many name changes. In the end the company was called Shearson Loeb Rhoades. Weill grew the company to be the country’s second largest securities brokerage firm, trailing only Merrill Lynch.

American Express (1981–1985)

In 1981, Weill sold Shearson Loeb Rhoades to American Express for about $915 million in stock. Weill began serving as president of American Express Co. in 1983 and as chairman and CEO of American Express’s insurance subsidiary, Fireman’s Fund Insurance Company. In 1984 Weill was succeeded by his protégé, Peter A. Cohen, who became the youngest head of a Wall Street firm. While at American Express, Weill began grooming his newest protégé, Jamie Dimon, who would later become the CEO and Chairman of JP Morgan Chase.

Before Citigroup (1986–1998)

Weill resigned from American Express in August 1985 at age 52.

Personal Life & Philanthropy

Sandy Weill married Joan Mosher in June, 1955. Joan Mosher, by the way, is that old girlfriend from back in the Bear Stearns days. The couple lives in Sonoma, California. They have two adult children and four grandchildren.

Together, this couple is among the most philanthropic in the country. They give to causes as varied as colleges, medical schools, research institutes, the New York Metropolitan Opera, and Carnegie Hall. As Joan Mosher Weill is quoted: “For us, philanthropy is much more than just writing a check. It’s donating your time, energy, experience, and intellect to the causes and organizations you are passionate about.” The list of generous gifts is long, so be prepared to read on for awhile, when the drum rolls.

Weill has also received many honorary degrees from colleges and universities around the country, including: Cornell University, Howard University, Hofstra University, University of New Haven, The New School and Sonoma State University. This couple puts their money where their hearts are.

[1] https://geraldrfordfoundation.org/centennial/oralhistory/sandy-weill/

[2] https://www.nytimes.com/1985/06/26/business/weill-s-departure-of-american-express.html

[3] https://www.latimes.com/archives/la-xpm-1985-06-30-fi-325-story.html

[4] https://henryehooper.blog/witness-post-commercial-credit-corp/