O. Henry: Devil Take the Hindmost

In Chapter 49 of Herman Melville’s Moby Dick is a sentence said aloud by the narrator, Ismael. Melville uses this sentence at the end of the chapter entitled Ahab’s Boat and Crew. Fedallah:

Now then, thought I, unconsciously rolling up the sleeves of my frock, here goes for a cool, collected dive at death and destruction, and the devil fetch the hindmost.

When did he say it and what did it mean at that time in history? It is such a striking comment, I had to research if there were some unusual meaning beyond the obvious. It was also curious to me that Melville first published his novel in 1861. After some cursory reviews, I found that the expression was first recorded in 1608.

According to a few internet sources, the devil taking the hindmost probably originated as an allusion to a children’s game in which the last child is the loser (coming in the most behind…“the hindmost”). Over the years the expression came to mean that everyone is out for themselves and, therefore, came to deal with others with utter selfishness. The writers seem to be saying, “Let everyone put his or her own interest first, leaving the unfortunate to their own sad fate.” For example, I don’t care if she makes it or not—the devil take the hindmost.

In later years, the expression similarly deployed self-interest and the devil in several stock trading strategies (as differentiated from speculation). The strategies provided a lively, original, and challenging history of investing in the stock market from the 17th century to present day. We are obviously smarter today than investors were in those bygone eras, right? As an example of some interesting questions on investing and speculation, and our own self-awareness are the two hypothetical queries below:

QUESTIONS: 1) Is your investment in that new AI stock a sign of stock market savvy or an act of peculiarly American speculative folly? What about Bitcoin? Are you informed or duped? 2) How has the psychology of investing changed—and not changed—over the last five hundred years? Have I researched how this time it is different?

In his novel, Devil Take the Hindmost, Edward Chancellor traces the origins of the speculative human spirit back even further to ancient Rome. He chronicles its revival in the modern world: from Holland’s tulip scandal of 1630s, to “stockjobbing” in London’s Exchange Alley. Chancellor places particular attention to the infamous South Sea Bubble of 1720, which famously prompted astronomer and mathematician Sir Isaac Newton to comment, “I can calculate the motion of heavenly bodies, but not the madness of people.”

Chancellor opines on brokers taking underwriting risks that included: highway robbery and the “assurance of female chastity;” credit notes and lottery tickets circulating as money; wise and unwise investors from Alexander Pope and Benjamin Disraeli to Ivan Boesky and Hillary Rodham Clinton.

From the Gilded Age to the Roaring Twenties, from the nineteenth century railway mania to the crash of 1929, from junk bonds and the Japanese bubble economy to the day-traders of the Information Era, Devil Take the Hindmost tells a fascinating story of human dreams and folly through the ages of our ancestors to the present day.

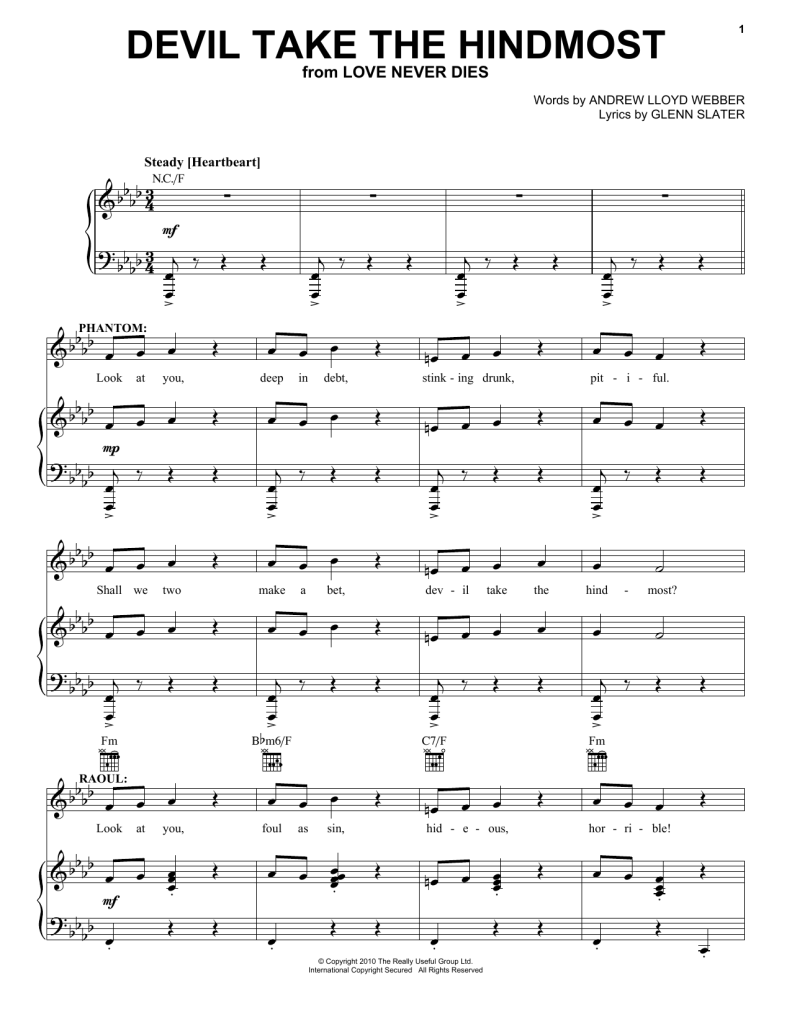

As a complete deviation from investing, comes the use of this same expression by the famous songwriter, Andrew Lloyd Webber. He and Glenn Slater take up the expression as the title to one of the quarter in Love Never Dies from the musical Phantom of the Opera: