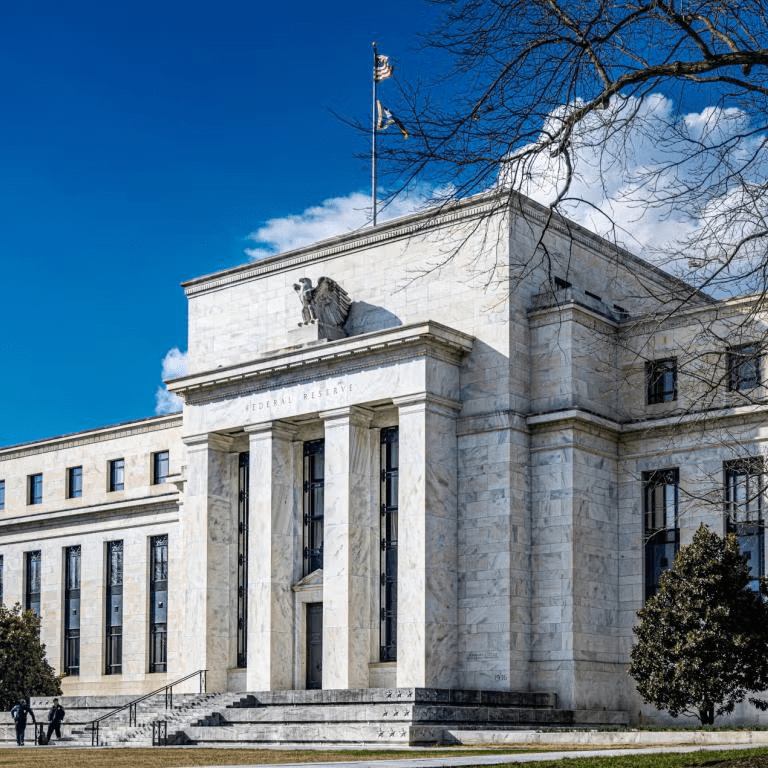

Friday Finance: The Federal Reserve

We hear about “The FED” all the time — in the news, in political debates, even in conversations about mortgages and credit cards. But what exactly is the Federal Reserve System, and why does it matter so much to every American? The answer is simple and vitally important: the Federal Reserve — often called “The FED” — is the cornerstone of a stable, healthy, and functioning U.S. economy. Its independence from politics is not a luxury; it’s a necessity. The economic stability of the global financial system depends on it.

The Federal Reserve’s Purpose

At its most basic, the Federal Reserve is the central bank of the United States. With roots extending to the First Bank of the United States chartered by Congress in 1791 and organized by Alexander Hamilton, the FED of today was created by Congress in 1913. Its mission is to promote a strong, stable economy that works for everyone. It has two official congressional mandates:

- Maximum Employment – ensuring that as many people as possible who want to work can find jobs.

- A Healthy, Sustainable Economy – supporting long-term growth without runaway inflation or financial instability.

To achieve these goals, the FED performs five main functions:

- Conducting Monetary Policy: Adjusting interest rates and controlling the money supply to manage inflation and support job growth.

- Providing Financial System Stability: Monitoring and responding to risks that could threaten the financial system.

- Supervising and Regulating Banks: Ensuring that banks operate safely and do not endanger the broader economy.

- Fostering Efficient Payment Systems: Overseeing the systems that allow money to move securely and reliably.

- Promoting Consumer Protection and Community Development: Safeguarding consumers and expanding fair access to financial services.

How the FED Is Structured

The Federal Reserve is not a single building of a single office — it’s a system made up of a national leadership team and twelve regional banks.

At the national level, the Board of Governors consists of seven members appointed by the President and confirmed by the Senate. They serve 14-year long, staggered terms designed to insulate them from short-term political pressures. And while there is intense scrutiny of the pronouncements by the Chair of the FED, currently Jerome Powell, it is always the majority vote of the entire committee that matters. As of October 2025, the members are:

- Jerome H. Powell – Chair

- Philip N. Jefferson – Vice Chair

- Michelle W. Bowman – Vice Chair for Supervision

- Michael S. Barr – Governor

- Lisa D. Cook – Governor**

- Christopher J. Waller – Governor

- Stephen I. Miran – Governor (appointed in September 2025)**

- ** note controvery about independence and Governors Cook and Miran below…

The system also includes 12 regional Federal Reserve Banks, each led by a president who provides insight into economic conditions in their district. Together with the Board, they form the Federal Open Market Committee (FOMC) — 12 voting members who meet eight times a year to set monetary policy.

These Federal Reserve branches help write and assemble what is called the Beige Book (referring to the color of the book cover) that is published 8 times a year. The book includes lots of granular details on the economy from each of the twelve districts. (See sidebar on the Beige Book below.)

| District | City / Region | President |

|---|---|---|

| 1 | Boston | Susan M. Collins |

| 2 | New York | John C. Williams |

| 3 | Philadelphia | Anna Paulson |

| 4 | Cleveland | Beth M. Hammack |

| 5 | Richmond | Thomas I. Barkin |

| 6 | Atlanta | Raphael W. Bostic |

| 7 | Chicago | Austan D. Goolsbee |

| 8 | St. Louis | Alberto G. Musalem |

| 9 | Minneapolis | Neel T. Kashkari |

| 10 | Kansas City | Jeffrey R. Schmid |

| 11 | Dallas | Lorie K. Logan |

| 12 | San Francisco | Mary C. Daly |

What the FED Measures — and Why It Matters

Each time the FOMC meets, it reviews key economic indicators that reflect the health and direction of the U.S. economy:

- Overnight Interest Rates: These are the short-term interest rates banks pay when they borrow money from each other or directly from the Federal Reserve to have enough cash on hand. (See sidebar on Overnight Rates below.)

- Employment Levels: The Fed seeks to keep unemployment near 4% for those adults who are actively seeking work.

- Inflation: The goal is about 2% annual inflation — enough to support growth without eroding purchasing power. (See sidebar on measuring Inflation Target below.)

- Bank Safety and Regulation: Ensuring that financial institutions operate responsibly and do not threaten the system.

These decisions have direct, everyday impacts — influencing how much people pay for homes, how easily businesses can hire, and how stable the prices of goods and services remain.

FED Independence: Stephen Miran Appointment, Lisa Cook Removal

Perhaps the most critical — and often misunderstood — feature of the Federal Reserve is its independence. The FED was deliberately designed by Congress to operate outside of short-term political pressures. While its leaders are appointed by elected officials and accountable to Congress, neither the President nor Congress can direct or dictate its monetary policy decisions.

This independence allows the FED to make tough choices — such as raising interest rates to control inflation — even when those choices are unpopular. If politicians could directly influence monetary policy, they might be tempted to favor policies that boost the economy temporarily before elections, even if those policies caused long-term damage on an international scale.

The appointment of Stephen I. Miran to the Board in September 2025 and potential removal of Governor Lisa D. Cook, by President Trump “for cause” underscores why independence matters. Miran, a former economic adviser known for his market-oriented views, was nominated to fill a vacant seat. His appointment sparked debate over whether political motivations were influencing the FED’s composition. Such appointments are legal and part of the process, but they highlight the delicate balance between democratic oversight and central bank autonomy. Lisa Cook, a longstanding Governor of the FED, has challenged her removal and the Supreme Court will weigh her case in January, 2026. Meanwhile, Cook has kept her seat on the FOMC. The system’s design — long terms, staggered appointments, and data-driven decision-making — is meant to ensure that the FED remains focused on the long-term health of the economy, not short-term political agendas.

Jerome Powell was first appointed Chair of the FED by President Trump in February, 2018. Powell’s current term as Chair expires in May, 2026, when a new Chair can be appointed.

The Bottom Line

The Federal Reserve might feel distant from daily life, but its actions touch nearly every part of the economy. It helps keep prices stable, jobs plentiful, and the financial system secure. Above all, its independence allows it to make decisions based on data and economic reality — not politics.

In short, we care about the FED because we care about our economic future. A strong, independent central bank is essential to keeping our economy stable, our banking system safe, and our opportunities growing. Protecting that independence isn’t just good policy — it’s vital to the prosperity and security of every American.

📊 SIDEBAR: What “Inflation Target” Really Means

The Federal Reserve’s inflation target is the rate of rising prices it considers ideal for a healthy economy — currently 2% per year.

- If inflation is too high, prices outpace wages and reduce purchasing power.

- If inflation is too low, it signals weak demand and can lead to stagnation or deflation.

To measure inflation, the Fed mainly uses the Personal Consumption Expenditures Price Index (PCE) — a broad measure of consumer spending tracked by the Bureau of Economic Analysis. PCE is preferred over the Consumer Price Index (CPI) because it captures a wider range of spending and reflects how consumers change their behavior when prices rise.

💸 SIDEBAR: What Is the “Overnight Rate”?

The overnight rate (officially the Federal Funds Rate) is the interest rate the FED charges, or banks charge one another, for short-term loans at the FED Window — often for just one night — to meet bank financial reserve requirements. While the FED doesn’t directly set all interest rates in the economy, this overnight rate sets the tone: it influences how much it costs to borrow money everywhere else, from home mortgages and credit cards to small business and auto loans. Mortgage rates, by the way, are set by the Bond Market and not the FED.

Why it matters:

- It’s the starting point for many other interest rates in the economy, including mortgages, car loans, and credit cards.

- When the Fed raises the rate, borrowing becomes more expensive, which slows inflation but can cool economic growth.

- When the Fed lowers the rate, borrowing becomes cheaper, stimulating spending and investment but risking higher inflation if the economy overheats.

By adjusting this Overnight Rate, the FED can steer the interest rates and the economy toward stable growth while keeping inflation under control.

📙 SIDEBAR: The Beige Book — The FED’s “Economic Storybook”

The Beige Book is a regular report published by the Federal Reserve Board of Governors themselves. It is officially titled Summary of Commentary on Current Economic Conditions by Federal Reserve District — but everyone calls it the Beige Book because of its original plain tan colored cover.

What’s in it:

The Beige Book is a collection of real-world economic observations gathered from each of the dozen regional Federal Reserve Banks. Instead of simply relying only on data and statistics from economists, it compiles on-the-ground information from business owners, community leaders, bankers and local organizations. Each district contributes a section of the book summarizing trends in their area such as:

- Employment and labor market conditions

- Consumer spending and retail sales

- Manufacturing and industrial activity

- Real estate and construction

- Banking and financial services

- Price trends and inflation pressures

Because it’s built from individual interviews and group surveys rather than just raw data, the Beige Book offers a more qualitative, narrative snapshot of how the economy is actually performing in real time.

How often it’s published:

The Beige Book is released eight times per year — roughly two weeks before each Federal Open Market Committee (FOMC) meeting. Policymakers read it very closely, as part of their preparation for the meetings. They use the information to assist in setting Fed Funds interest rates and deciding on other monetary policies.

Why it matters:

Despite is bland name, the Beige Book is a good read for anyone really interested in the economy, really! While it doesn’t include forecasts or formal policy recommendations, the Beige Book gives the FED — and the public — a ground-level view of how Americans are experiencing the economy. Its insights often reveal turning points or emerging trends before they appear in official data. Even if you only read it once, it will offer keen insights into that six-week snapshot of our economic storybook, as narrated by the FED.