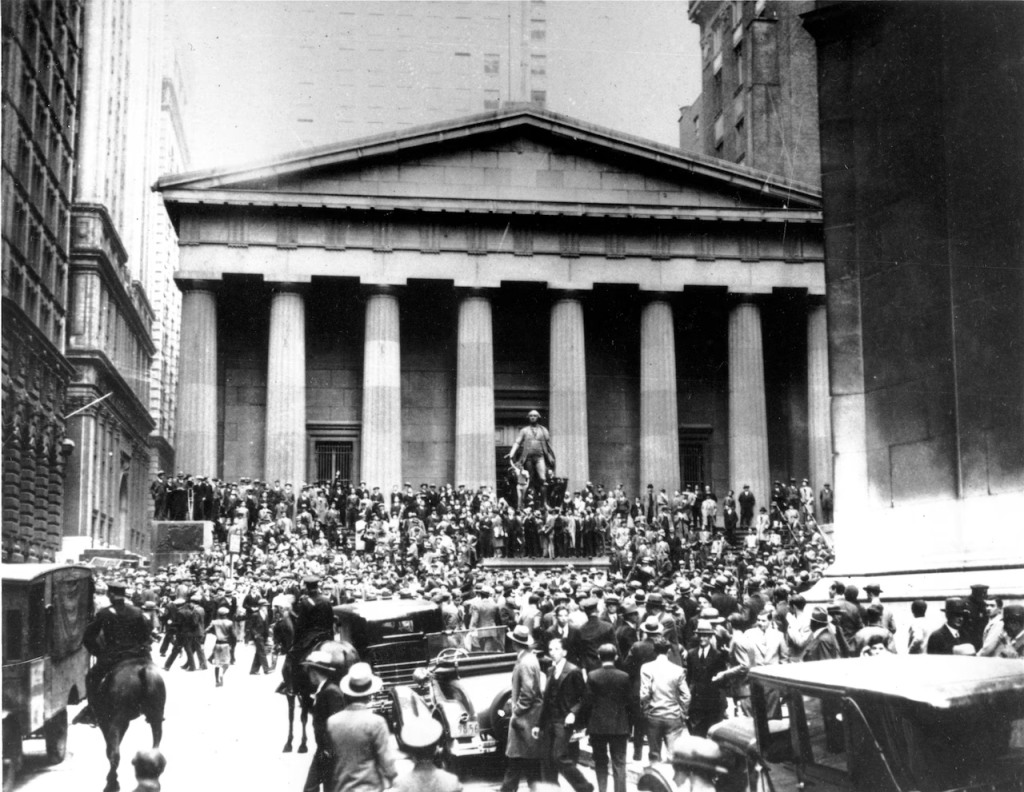

Friday Finance: Party like it’s 1929

(September, 2025) The stock market has hit all-time highs on all three major indices: DJIA, NASDAQ, and S&P500. Does the party go on and on (As Prince warns about the year 2000)?[1] Or is there a different reaction and direction from the fickle market? Are happy days here again or are we actually in darker times? Are we approaching the end of the Roaring ’20s? Only this time its a century later? One contrarian investor bets, “beware.” We ARE at an inflection point.

His name is Mark Spitznagel, and he is known on the Street as “the Crash guy.”[2] A successful goat farmer and goat-cheese purveyor from Michigan, he may seem naive or innocuous; however, take note: He has made $billions (yes, that’s with a $B) in the stock market. His previous bets include raking in profits, when Lehman Brothers failed (2008), the Flash Crash occurred (2015), and Covid-19 shut down the economy (2020).

Spitznagel, through his firm Universa Investments, invests primarily for pension funds. He is a protégé of Nassim Taleb, author of The Black Swan, Fooled by Randomness and other books. Universa buys investments that are like an insurance policy with what is known as “tail-risk protection.” These investments take losses most of the time and then pay off hugely, if a financial downturn is particularly sharp. And Spitznagel is at it again.

As investors know, it is extraordinarily difficult to “time the market.” There is little to no certainty as to when it will go up and when it will go down, and how sharply. And it can be disasterous to investors, who are on the wrong side of the market.

Spitznagel has some advice for investors out there: know your tolerance for downward volitility. “The biggest risk to investors isn’t the Market, it’s themselves,” he warns. This time around, Spitznagel cites the repeated rescues of the Markets and banks by the Federal Reserve as part of the assumed financial guardrails. He characterizes the danger in a rhetorical metaphor: what if the Forest Service’s practice were to quickly extinguish all forest fires, only to realize the policy is accumulating way too much dry tinder? That dry tinder could set up the forests for a “fire-bomb” that burns hotter than previous conflagrations.

Ending his thoughts on a very sanguine note, Spitznagel says, “The markets are perverse. They exist to screw people.”

Yikes, sounds like it is wise to look for some tail-risk potection, while we are shaking our booty in 2025.

References:

[1] The song, entitles “1999” is the titular song and lead single of Prince’s 1982 breakout album, Genius. The song – the album opener – introduces an apocalyptic universe that asks the listener to live their life until they can’t anymore. Many people believed the world would end in the year 2000. To “party like it’s 1999” would simply having the party of your life, as you would do if you were partying for the last time before the world ends.

[Verse 1: Prince, Lisa, Dez, All]

I was dreamin’ when I wrote this

Forgive me if it goes astray

But when I woke up this morning

Could have sworn it was judgement day

The sky was all purple

There were people runnin’ everywhere

Tryin’ to run from the destruction

You know I didn’t even care

[Chorus: All] They say

2000, zero-zero, party over, oops, out of time

So tonight, I’m gonna party like it’s 1999

[2] From an article (September 23, 2025) entitled Market to Party Like 1929, “Crash Guy” Says on page B9 of the Wall Street Journal, Heard on the Street section, written by Spencer Jakab.