Friday Finance: Insurance

Insurance, at its core, is a simple idea: it’s a way to protect yourself from the kinds of problems that would be financially devastating, if you had to pay for them out of your own pocket. Instead of carrying all that risk, you pay a smaller, predictable amount to an insurance company. In exchange, they promise to step in and cover the big costs, if something bad happens. In other words, you are transferring the risks for that policy to the insurance company. You are trading uncertainty for stability. You may never need the protection, but if you do, it can save you from a financial quagmire and catastrophic losses that may ensue.

Below is a rough outline as to the steps and mechanics of insurance. If there is a policy that you are investigating, do the research you need to 1) know your risk profile, 2) find the company that will stand by the policy and protect you from harm, and 3) find a broker who can get you the plan that matches your needs.

All types of insurance follow this same basic pattern:

- You sign up for a policy—the contract that explains what’s covered and what isn’t. Be sure to read the fine print, making sure that you are clear as to what is covered and what is not. At this point, if you are new or vague as to the value of the policy to you, be sure to engage an insurance broker, who can help direct you to the policy that is best for you and your circumstances.

- You pay the insurance premiums, usually monthly, semi-annually or yearly.

- If something happens that the policy covers, you file a claim. And then …

- The insurance company uses the pool of money collected from all customers to pay for your loss.

Insurance companies spread the risk for uncertain events among thousands or millions of people, so that no one person has to absorb the full blow.

Life Insurance

Life insurance is probably the most straightforward example of insurance and the transfer of risk. You pay premiums while you’re alive, and if you pass away, the insurance company pays a lump sum to your beneficiaries, the people you choose to get the money. The idea is to replace the financial support you would have provided—income, childcare, mortgage payments, future education costs, or even just peace of mind. People often use life insurance to make sure their family isn’t suddenly dealing with both grief and financial strain. There a different types of life insurance to consider, while you are digging into the topic. First question: do you want your policy to handle your death and loss of life, or do you want the insurance to be an investment policy? If you want it the insurance as a death policy, sign up for TERM insurance. If you want it for an investment and death, sign up for a WHOLE LIFE or Universal Life policy.

I have a background in investments, so I have only had TERM insurance policies covering my life as well as the life of my spouse. My investments are separate and distict from my insurance policies. Others may want some residual savings to accompany the life events insurance, so they will opt for a WHOLE LIFE or Universal Life policy, which can be passed to designated and contingent beneficiaries.

Health Insurance

Health insurance is one of the most important forms of coverage because medical care in the U.S. is extremely expensive. A single trip to the emergency room can run thousands of dollars, and hospital stays or surgeries can cost tens or even hundreds of thousands. Even routine care can add up quickly if you’re uninsured.

A typical health insurance plan uses specific language and divides costs between you and the insurer in a few ways such as premiums, deductibles, copays, coinsurance and out-of-pocket costs:

- Premium: What you pay every month just to have the insurance.

- Deductible: The amount you have to pay first each year before the insurance kicks in for many services. For example, if you have a $2,000 deductible, you pay the first $2,000 of covered medical expenses.

- Copays: Small set fees for specific services like $25 for a doctor visit or $10 for a prescription.

- Coinsurance: A percentage of the cost you share with the insurer after you’ve hit your deductible (e.g., you pay 20%, they pay 80%).

- Out-of-pocket maximum: This is your “worst-case scenario” cap. Once you hit this number in a calendar year, the insurance company pays 100% of everything else that’s covered. The clock starts over at the beginning of the next year.

What health insurance really protects you from is a financial catastrophe. It prevents a medical emergency from turning into a years-long debt spiral. Even a relatively healthy adult benefits from coverage because accidents, unexpected illnesses, or chronic conditions can appear without warning. Plus, most plans also cover preventive care; i.e. the annual checkups, basic screenings, vaccinations, which can catch issues early and save money in the long run.

As you approach retirement and the age of 65, it is important to know what MediCare coverages you will be considering when you are near that age or time of life. It is important to know how Social Security and MediCare work together to make sure that you are paying your fair share of the benefits you have saved for during your working life.

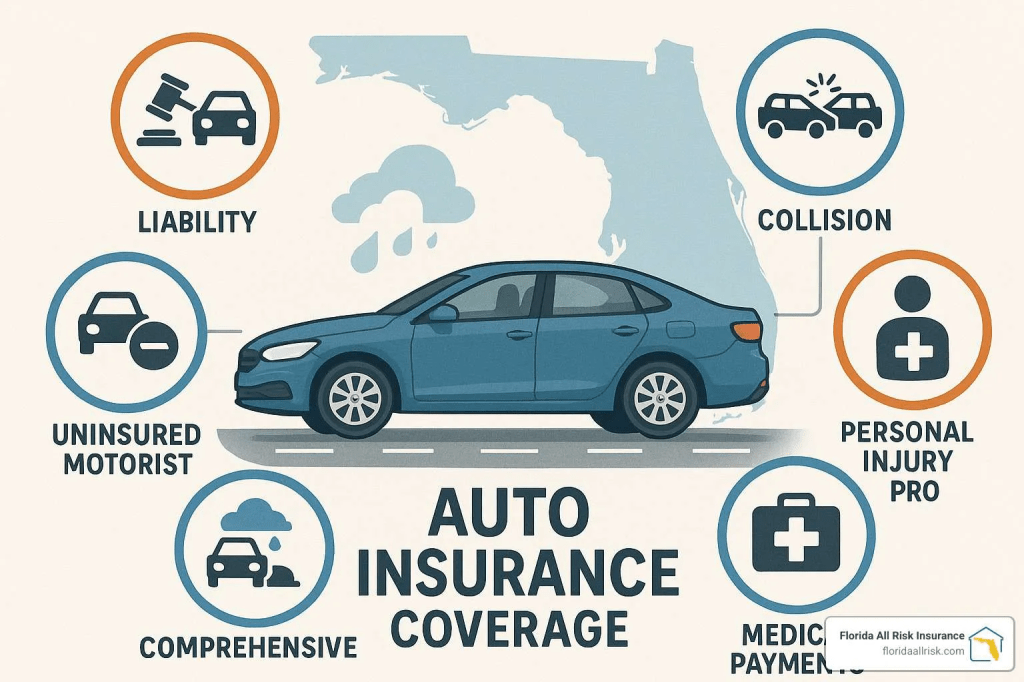

Automobile Insurance

Auto insurance protects you financially if your car is damaged or if you cause damage to someone else’s property or vehicle. Most states require at least a basic level of auto coverage because accidents can be so expensive. If you’re responsible for injuring another driver or damaging someone’s car, auto insurance ensures you’re not writing an enormous check out of pocket. It also helps repair or replace your own car after a crash, theft, or other covered incident.

Car insurance is really a bundle of several different protections. Each part covers a different piece of the picture—you, your passengers, your car, and other people and their property. Not everyone needs the same mix, but understanding each type makes it easier to decide what’s essential for your situation.

1. Liability Coverage (Covers Other People and Their Property)

This is the most important part of auto insurance and is required in almost every state. It protects other people when you cause the accident. Liability has two main pieces:

Bodily Injury Liability:

This pays for the other person’s medical bills, lost wages, rehab, and sometimes legal costs if you injure someone in a crash. Please note: It does not pay for your injuries. It applies to other drivers, passengers in the other car, pedestrians, cyclists—anyone you accidentally hurt.

Property Damage Liability:

This pays for damage to other people’s property; i.e. their car, their fence, mailbox, or garage, or municiple (City) property like guardrails or traffic signs. If you cause the accident, liability coverage prevents you from having to pay those costs out of pocket.

2. Collision Coverage (Covers Your Car if You Crash)

Collision pays to repair or replace your own vehicle if it’s damaged in an accident—whether it’s your fault or not. It covers things like: Hitting another car; Backing into a pole; Sliding on ice and hitting a curb; Someone hitting your parked car (in some cases). You typically pay a deductible, and the insurance company covers the rest.

People often drop collision as their car gets older and the value goes down, but for newer or more expensive vehicles, it’s usually essential.

3. Comprehensive Coverage (Covers Your Car from Non-Crash Damage)

Comprehensive handles damage to your vehicle from pretty much anything other than a collision. Think of it as “everything but crashing.” It covers: Theft, Vandalism, Fire, Flood, Hail, Falling trees or debris, Animals (e.g., hitting a deer)

Like collision coverage, comprehensive also has a deductible. These two—collision and comprehensive—are what lenders require if you’re financing or leasing a car.

4. Personal Injury Protection (PIP) or Medical Payments (MedPay)

This part covers you and your passengers, no matter who caused the accident. The name depends on your state. PIP (Personal Injury Protection) is broader and includes: Medical bills, Lost wages, Childcare, and Funeral expenses. It’s required in all “no-fault” insurance states. (Neither Oregon nor Colorado is a “no-fault state.”)

Medical Payments (MedPay) is more basic and covers only medical expenses for you and your passengers. These are the coverages that directly protect the people inside your car.

5. Uninsured and Underinsured Motorist Coverage (Protects You From Other Drivers’ Mistakes)

This protection covers you and your passengers if another driver hits you and doesn’t have insurance or doesn’t have enough insurance. It can pay for: Your medical bills, Your passengers’ injuries, Damage to your car (in some states). This is a surprisingly important coverage, because millions of drivers carry only minimal insurance, and many drivers have no insurance at all.

Homeowner’s Insurance

Homeowners insurance covers the structure of your home as well as the belongings inside it. If your house burns down, is damaged in a storm, or is burglarized, the insurance company steps in to pay for repairs or replacements up to the limits on your homeowner’s policy. It can even cover temporary housing, if your home has damage and becomes unlivable. Renter’s insurance works the same way for people who don’t own their home, except it covers their (your) belongings but not the building itself. (See more on Renter’s Insurance below.)

A category people often underestimate is flood insurance. Standard homeowners and renters insurance usually doesn’t cover damage from rising water, so flood insurance is its own separate policy. For anyone who lives near the coast, a major river, or even in an area where intense storms are common, flood coverage can prevent a huge financial hit that a regular home policy wouldn’t touch. This type of insurance comes from the federal government through FEMI. The increase in flooding due to climate changes and the areas covered for flooding are in constant flux, so make sure you have access to the latest flood zone maps, and make sure you know and can assess the risks of living or building in a potential flood zone.

Renter’s Insurance

If you rent instead of own your place of residence, renter’s insurance is one of the simplest and most affordable ways to protect yourself; however, it’s also one of the most overlooked. Renter’s insurance covers three major categories:

- Your belongings: This can include furniture, electronics, clothing, appliances you bought, and valuables. If there’s a fire, burglary, water leak, or certain types of storm damage, the policy pays to replace your items. Many people underestimate the total value of their belongings; even modest apartments can contain tens of thousands of dollars in items.

- Liability protection: If someone gets hurt in your apartment and decides to sue you—maybe they trip, fall, or get bitten by your pet—liability coverage pays legal fees and settlements. This is the part people don’t always think about, but it’s incredibly important.

- Temporary living expenses (loss of use): If the building becomes unlivable (a fire, burst pipe, etc.), this coverage pays for a hotel or short-term rental while repairs are made. Without this, you’d be on the hook for emergency housing.

For many adults, renter’s insurance costs roughly the same as a monthly streaming subscription. At that price, it’s one of the best value protections available.

Disability Insurance

Another key type of coverage is disability insurance. This one doesn’t get talked about as much, but it’s arguably as important as life insurance. Disability insurance replaces part of your income if you’re unable to work due to an illness or injury. Considering that your ability to earn a living is often your biggest financial asset, this kind of coverage can keep your household afloat during a tough period. Many companies have short term disability but not long-term disability. Make sure you know the types of protections you have through your employer, before signing up for a particular policy.

Liability and Umbrella Insurance

Finally, there’s liability insurance and its bigger cousin, umbrella insurance. These cover situations where someone sues you or holds you responsible for injuring them or damaging their property. Your auto and home insurance include some liability protection, but umbrella policies add an extra layer in case you face a major claim. It’s protection against worst-case scenarios—things that are unlikely but could be financially devastating if they did happen.

Insurance Summary

Overall, the idea behind all these types of insurance is the same: you pay a manageable amount today so you don’t have to face a huge, unpredictable bill in the future. It’s a tool for stability, for protecting your financial life from events that could otherwise derail it. When you think of insurance in that way—as transferring risk rather than just buying a product—it becomes much easier to understand why each type exists and when you might need it.