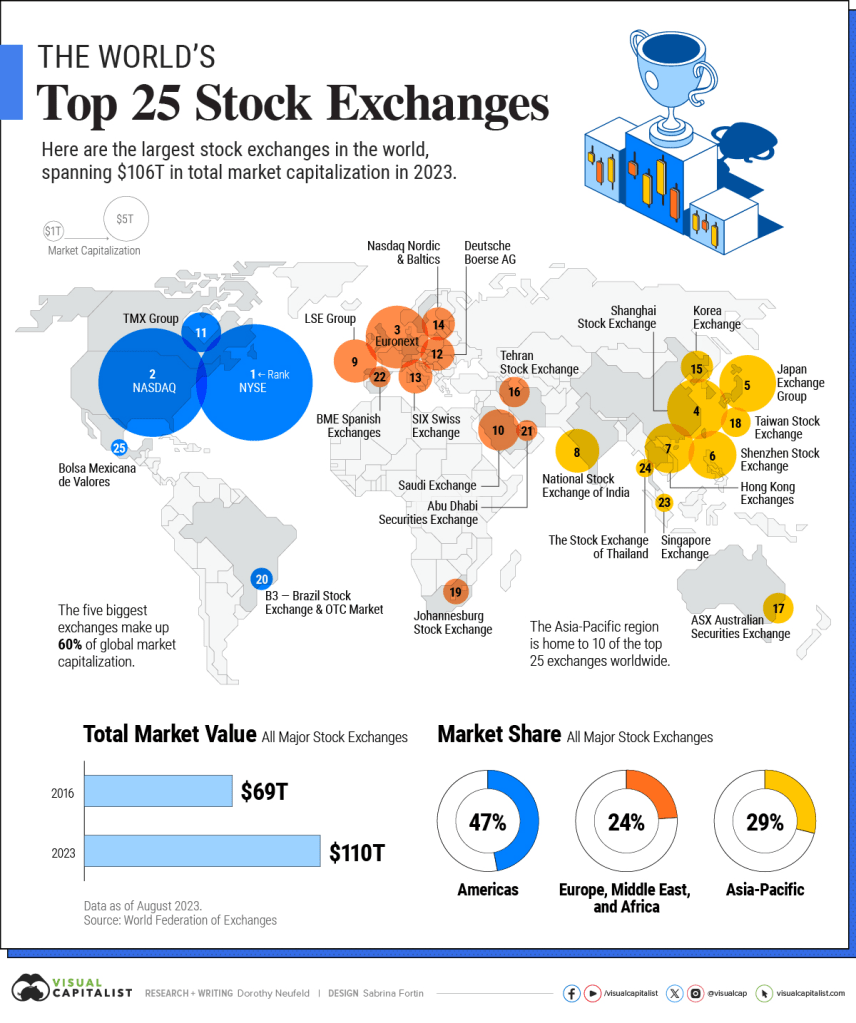

Top Global Trade Exchanges

During our last Friday Finance session (January 16, 2026), I asked all of our attendees if it would be helpful to know where in the world all of these stocks, bonds, commodities, currencies and such are visible. The quad of attendees gave a resounding YES. So, below is an attempt to gather the current data and to display where the exchanges are, what they do, and why we should care. The goal of this Friday Finance post is to help interested players to understand the value created by exchanges, and how important it is to have a smooth transfer of assets from current owners of companies to future owners.

The Exchanges for this exercise are weighted by size, as best we could determine. Below (in paragraph form) at the world’s top 30 exchanges as of 2024. The sizes of these exchanges are listed in USD (or US$Dollars) for easy comparison.[1]

Noto Bene: Friday Finance readers should note that the platform exchanges featured in this post are limited to formal financial exchanges for stocks, options, commodities, and bonds, characterized by standardized instruments, centralized price discovery, and established regulatory oversight.

Excluded from this list are trading venues for private real estate (e.g., MLS, LoopNet), digital assets (e.g., cryptocurrency platforms and memes tokens exchanges), currencies (e.g. FOREX), predictive or event markets (e.g. Kalshi, Polymarket), gaming and wagering platforms (e.g. FanDuel, DraftKings), and informal or non-regulated exchange systems.

While several of these excluded platforms are experiencing rapid growth and increasing mainstream acceptance, they operate under different regulatory frameworks, liquidity structures, and risk control measures than traditional securities and derivatives exchanges, and therefore fall outside the scope of this Friday Finance analysis.

Here we go with the drum roll list of exchanges, please:

1. New York Stock Exchange (NYSE), United States.

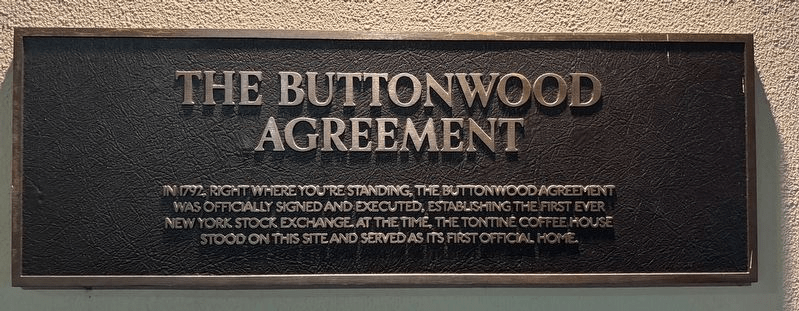

The New York Stock Exchange traces its origins to the 1792 Buttonwood Agreement [2] and evolved through the 19th and 20th centuries into its modern form. It lists roughly 2,100–2,250 companies and represents the largest equity market in the world, with an aggregate market capitalization commonly estimated between US$30 trillion and US$38 trillion. The NYSE is distinguished by deep liquidity, heavy institutional participation, and its role as the primary home for many of the world’s most established blue-chip corporations.[1]

2. Nasdaq Stock Market, United States.

Founded in 1971 as the world’s first electronic stock market, Nasdaq now hosts approximately 4,000 listed companies, with over 4,075 across the broader Nasdaq group as of late 2024. Its total market capitalization rivals that of the NYSE at roughly US$30–36 trillion. Nasdaq is especially associated with technology, growth companies, IPO activity, and a high proportion of international and small- to mid-cap issuers.

3. CBOE Global Markets, United States (global operator).

Established in 1973 originally as an options exchange, CBOE is not a traditional equity listing venue in the same sense as other exchanges. Instead, it operates multiple trading venues across equities, ETFs, options, and derivatives. Cboe itself is publicly listed, with a corporate market capitalization on the order of US$20–30 billion, and is best known for its central role in options and derivatives market infrastructure.

4. Japan Exchange Group (JPX – Tokyo Stock Exchange), Japan.

The Tokyo Stock Exchange dates back to 1878, with Japan Exchange Group formed in 2013 through the merger of the Tokyo and Osaka exchanges. JPX lists roughly 3,940–3,970 companies, making it one of the largest exchanges globally by number of issuers. Total market capitalization typically falls in the US$6–7 trillion range, reflecting Japan’s broad domestic corporate base from legacy industrial groups to modern technology firms.

5. Shanghai Stock Exchange (SSE), China (Mainland).

Re-established in 1990, the Shanghai Stock Exchange is mainland China’s largest exchange by market capitalization. Its main boards include more than 1,200 listings, with the STAR Market operating separately for innovation-focused firms. Total market capitalization fluctuates widely but is often estimated between US$5 and US$8 trillion. The exchange is characterized by a heavy presence of large state-owned enterprises alongside growing technology listings.

6. Shenzhen Stock Exchange (SZSE), China (Mainland).

Also modernized in the early 1990s, the Shenzhen Stock Exchange complements Shanghai by focusing more heavily on small- and mid-capitalization firms and growth companies. It hosts approximately 2,600–2,900 listings, with total market capitalization around US$4–5 trillion. SZSE is particularly associated with technology, manufacturing, and entrepreneurial firms.

7. Hong Kong Exchanges & Clearing (HKEX), Hong Kong.

HKEX was formed in 2000 through a series of consolidations and today lists roughly 2,600–2,700 companies. Its market capitalization generally ranges from US$3.5 to over US$4 trillion, varying with market conditions. HKEX serves as a critical gateway between mainland Chinese issuers and international investors and is known for strong IPO activity and an active derivatives market.

8. Euronext, Pan-European.

Founded in 2000 through the merger of several national exchanges, Euronext operates a consolidated platform spanning France, the Netherlands, Belgium, Portugal, Italy, and Ireland. It lists approximately 1,700–1,900 companies, with a combined market capitalization around US$5–6 trillion. Euronext is notable for its integrated pan-European order book and broad sectoral coverage across EU corporates.

9. London Stock Exchange (LSE / LSEG), United Kingdom.

Formally established in 1801, with much deeper historical roots,[3] the London Stock Exchange lists roughly 1,000–1,900 issuers depending on classification. Total market capitalization is typically estimated between US$4 and US$6 trillion. The LSE is highly international, with strong bond and derivatives markets and a long-standing role as a global center for capital formation.

10. Toronto Stock Exchange (TSX), Canada.

The TSX traces its modern roots to 1861 and operates under TMX Group following consolidation. The TSX itself lists about 1,500–1,700 companies, while the TSX Venture Exchange adds another 1,200–1,800 junior and exploration issuers. TSX market capitalization alone generally falls in the US$3–4 trillion range, with a distinctive emphasis on mining, energy, and resource finance.

11. B3 – Brasil Bolsa Balcão, Brazil.

B3 represents the consolidation of Brazil’s historical exchanges into a single entity, finalized in its modern form in 2017. It lists approximately 330–350 companies, with total market capitalization typically between US$600 billion and US$900 billion. B3 is the largest exchange in Latin America and is heavily weighted toward commodities, banking, agriculture, and energy.

12. Korea Exchange (KRX), South Korea.

Formed through a series of mergers in the early 2000s, the Korea Exchange lists roughly 1,300–1,600 companies. Market capitalization generally ranges from US$1.4 trillion to US$1.7 trillion. KRX is home to major chaebol groups such as Samsung and Hyundai and reflects South Korea’s export-driven, technology-focused economy.

13. National Stock Exchange of India (NSE), India.

Founded in 1992 as a fully electronic market, the NSE has become India’s dominant exchange by trading volume. It lists hundreds to over 1,600 companies, with India’s total equity market capitalization exceeding US$3–4 trillion. The NSE is especially known for its advanced trading technology, deep derivatives markets, and exposure to financials and technology.

14. Bombay Stock Exchange (BSE), India.

Established in 1875, the BSE is one of the oldest stock exchanges in the world. It historically lists thousands of companies, though active listings are fewer in practice. While India’s total market capitalization is shared with the NSE, the BSE stands out for its exceptionally broad small- and mid-cap universe and long institutional history.

15. Indonesia Stock Exchange (IDX), Indonesia.

The IDX was formed in 2007 through the merger of the Jakarta and Surabaya exchanges, though its roots extend further back. It lists approximately 700–800 companies, with total market capitalization commonly estimated between US$500 billion and US$800 billion. The exchange provides exposure to commodities, banking, and Indonesia’s large domestic consumer market.

16. Johannesburg Stock Exchange (JSE), South Africa.

With origins in the early 19th century and extensive modernization over time, the JSE lists roughly 300–400 companies. Its market capitalization often exceeds US$700 billion and can approach US$1 trillion. The JSE is the largest and most sophisticated exchange in Africa, historically dominated by mining and resource companies.

17. Mexican Stock Exchange (BMV), Mexico.

Founded in 1894 and modernized over time, the BMV lists approximately 120–150 companies on its main board. Total market capitalization typically ranges from US$600 billion to US$1 trillion. The exchange reflects Mexico’s integration into North American supply chains, with strengths in manufacturing, telecommunications, and consumer sectors.

18. Santiago Stock Exchange, Chile.

Established in 1893, the Santiago Stock Exchange lists roughly 200–300 companies and has a market capitalization generally between US$200 billion and US$400 billion. Chile’s market is closely tied to copper and other natural resources, and the exchange serves as a regional financial hub in South America.

19. Buenos Aires Stock Exchange (BYMA), Argentina.

Dating back to 1854, with modern consolidation into BYMA completed in 2019, Argentina’s main exchange lists approximately 100–200 companies. Market capitalization is comparatively small and highly volatile due to currency fluctuations, though the exchange includes significant agricultural and energy firms.

20. Warsaw Stock Exchange (WSE), Poland.

Re-established in 1991 after the fall of communism, the WSE lists around 400–500 companies. Market capitalization generally falls between US$100 billion and US$300 billion. It is the largest exchange in Central and Eastern Europe and serves as a gateway to emerging European markets within the EU.

21. Borsa Istanbul (BIST), Türkiye.

Modernized in the 1980s and 1990s, with much older trading traditions, Borsa Istanbul lists roughly 300–400 companies. Market capitalization typically ranges from US$100 billion to US$300 billion. The exchange bridges Europe and Asia and is dominated by banks and large industrial conglomerates, with sensitivity to currency and geopolitical conditions.

22. Ho Chi Minh Stock Exchange (HOSE), Vietnam.

Established in 2000, HOSE lists approximately 400–600 companies and represents the core of Vietnam’s equity market. Market capitalization has been rising rapidly as the economy develops, driven by manufacturing, exports, and domestic consumption. HOSE is widely viewed as one of Asia’s fastest-growing exchanges.

23. Singapore Exchange (SGX), Singapore.

Formed in 1999 through a merger, SGX currently lists about 500–700 companies, though listings have declined somewhat due to cross-listings elsewhere. Market capitalization typically ranges from US$600 billion to US$1 trillion. SGX is distinguished by its strength in derivatives, commodities, and REITs and its role as a regional financial hub.

24. Stock Exchange of Thailand (SET), Thailand.

Founded in 1975, the SET lists approximately 600–700 companies with a market capitalization generally between US$200 billion and US$500 billion. The exchange reflects Thailand’s tourism, banking, and consumer sectors and operates within a relatively stable regulatory framework for the region.

25. Philippine Stock Exchange (PSE), Philippines.

Formed in its modern structure in 2013 through the merger of earlier exchanges, the PSE lists roughly 200–300 companies. Market capitalization typically falls between US$100 billion and US$300 billion. The market is concentrated, dominated by banks and large conglomerates, and tied closely to domestic consumption growth.

26. Tadawul (Saudi Stock Exchange), Saudi Arabia.

Founded in 2007 in its modern form, with major reforms during the 2010s, Tadawul lists approximately 200–250 companies. Its market capitalization is very large relative to listing count, often estimated between US$1.8 and US$2.5 trillion or more, largely due to Saudi Aramco. Tadawul is the largest exchange in the Middle East and central to Saudi Arabia’s Vision 2030 reforms.

27. Abu Dhabi Securities Exchange (ADX), United Arab Emirates.

Modernized in the 2000s, ADX lists roughly 70–100 companies. While smaller than Tadawul, it has been growing rapidly, supported by energy, financial institutions, and sovereign-backed enterprises. ADX is among the fastest-expanding exchanges in the Gulf region.

28. Nigerian Exchange Group (NGX), Nigeria.

With earlier roots and a formal rebranding in 2021, the NGX lists approximately 160–200 companies. Market capitalization varies widely, often between US$50 billion and US$200 billion, reflecting currency volatility. The exchange is strategically important given Nigeria’s population size and emerging fintech and consumer sectors.

29. Vietnam Exchange System (HOSE + HNX), Vietnam.

Vietnam’s equity market operates through the combined system of the Ho Chi Minh Stock Exchange and the Hanoi Stock Exchange. Together they list roughly 500–700 companies, with total market capitalization rising steadily alongside economic growth. The system is young but expanding quickly, supported by manufacturing exports and capital-raising demand.

30. Kazakhstan Stock Exchange (KASE), Kazakhstan.

Established in 1993 during the post-Soviet transition, KASE lists roughly 100–300 instruments, including equities, bonds, and ETFs. The exchange is heavily focused on commodities and energy and provides regional exposure to Central Asian resource markets.

Five most load-bearing sources I used for recent numbers / context

- Nasdaq 2024 Form 10-K / SEC filing — Nasdaq lists ~4,075 companies on The Nasdaq Stock Market as of Dec 31, 2024. SEC

- Nasdaq IR: Nasdaq welcomed 171 IPOs in 2024 and continued listing activity in H1-2025 (shows listing pace & role). Nasdaq IR+1

- Japan Exchange Group (JPX) — JPX / Tokyo listing counts ~3,940+ (Nov 2025); official JPX listing page. Japan Exchange Group

- Shanghai Stock Exchange / STAR market reporting — STAR had ~581 listings (end-2024) and SSE reporting on covered market value and initiatives. State Council of China+1

- Hong Kong Exchanges (HKEX) monthly consolidated statistics — ~2,600+ listed companies and market cap snapshots (monthly reports). HKEX+1

Quick takeaways & how to use this table

- If you want “depth/liquidity & blue-chips”: focus on the following exchanges — NYSE, Nasdaq, JPX (Tokyo), HKEX, LSE.

- If you want “breadth of domestic small/mid caps”: JPX (Japan), BSE (India), TSXV (Canada junior), Shenzhen (China).

- Commodity/resource exposure: TSX/TSXV (Canada), B3 (Brazil), JSE (South Africa), Santiago (Chile).

- Fastest-growing / high-upside EMs to watch: Vietnam (HOSE/HNX), India (NSE/BSE), Indonesia (IDX), Saudi (Tadawul).

- Infrastructure & derivatives matters: CBOE, CME (I didn’t list CME above but it’s another major derivatives/clearing operator worth including if you want derivatives focus).

📊 Major Exchanges Table (including Nasdaq / NYSE / CBOE)

| Exchange (Operator) | Region / Country | Founded / Origin (or relevant origin) | Approx. # Listed Companies / Issues* | Estimated Total Market Capitalization (of listed companies)† | Notable / Unique Qualities |

| New York Stock Exchange (NYSE) | USA | Founded in 1792 (Buttonwood-type origins; later formalized). | ~ 2,164–2,179 listed companies/issues (domestic + foreign; as of early 2025) focus.world-exchanges.org+1 | ~ US$ 38.5 trillion (or in many rankings ~ US$ 31–32 trillion) marketcap.company+1 | The largest exchange by market cap, home to many of the world’s largest blue-chip, multinational firms. Provides deep liquidity, stability, and global visibility. |

| Nasdaq | USA | Founded 1971 (as a modern electronic/quotation exchange). Wikipedia+1 | ~ 3,263–3,291 listed issues (domestic + foreign) as of early 2025. focus.world-exchanges.org+1But per Nasdaq’s own disclosure: as of December 31, 2024, 4,075 companies had listed securities on Nasdaq. Wikipedia | ~ US$ 35.8 trillion (some rankings) or ~ US$ 29.9–30.8 trillion depending on method/data source. marketcap.company+1 | Known as the “tech- and growth-heavy” exchange. Many technology, biotech, high-growth, and small/mid-cap companies choose Nasdaq over NYSE — giving it a “younger” / more dynamic flavor vs. NYSE’s “blue-chip” profile. Also a popular venue for international and foreign-company listings. |

| CBOE Global Markets (CBOE) | USA (global operator) | Founded in 1973 (originally as an options exchange) Wikipedia+1 | The public “listed-company count” for Cboe is not comparable to NYSE/Nasdaq: as a marketplace operator, Cboe doesn’t list the bulk of standard equities. (According to one 2025 summary, only “1” listed company is counted under “Cboe Global Markets” in broad equity-exchange statistics. ) focus.world-exchanges.org+1 | Cboe as a publicly traded company has a corporate market cap (its own equity value) of ~US$ 27 billion (not to be confused with “market cap of listed companies on the exchange”). Companies Market Cap+1 | Cboe’s strength is in market infrastructure, derivatives, alternative trading venues, and global trading/clearing networks — not in being a “traditional listing exchange” like NYSE/Nasdaq. It owns or operates multiple trading platforms, especially for options, ETFs, alternative vehicles, and has significant influence on U.S. & global markets through those. S&P Global+1 |

* “Listed companies/issues” — total of domestic + foreign-listed securities.

† “Market capitalization” refers to the combined market value of all listed companies’ outstanding shares (for NYSE & Nasdaq). For CBOE, the “~US$ 27B” refers to the market cap of CBOE as a publicly traded company (i.e. the exchange operator), not the aggregate value of companies listed on the exchange — because CBOE is not primarily a traditional broad-stock listing venue.

ℹ️ Important Notes & Caveats When Interpreting This Data

- The “# listed companies / issues” can differ depending on whether you count every listed security and foreign-issuer, or just “domestic common-stock” — which makes cross-exchange comparisons a bit messy.

- Market-cap rankings vary by data provider and valuation method: some use float-adjusted market cap, some use total market cap, some exclude certain securities. That’s why some sources list Nasdaq’s cap at ~US$ 29.9 trillion while others ~US$ 35.8 trillion. marketcap.company+1

- For an operator like Cboe, “market cap” data refers to the exchange-operator company itself (i.e. investors owning Cboe shares) — not the aggregate value of all securities traded on its venues. This is fundamentally different from how exchanges like NYSE or Nasdaq are treated when we talk about “size.”

- Because Cboe’s business is more about infrastructure (exchanges, derivatives, ETFs, clearing, multiple venues) than broad-scale equity listing, using “number of listed companies” is not very meaningful for it — it’s more relevant to look at trading volume, market share of trading in the US, derivatives & options activity, etc. Cboe Global Markets+2Cboe Global Markets+2

🎯 What This Adds to the Global Picture

With this data:

- You see that the largest single exchanges by value remain NYSE and Nasdaq — together these cover a massive portion of global equity market cap.

- Nasdaq’s strength in growth-oriented, tech, international, small/mid-cap listings nicely complements NYSE’s “blue-chip, high-stability” profile.

- Cboe plays a different but crucial role — as a backbone infrastructure provider, derivatives and ETF-market operator, and alternative trading venue — important especially in a diversified global-market ecosystem, even if it doesn’t show tens of thousands of listed equities like the others.

- By having both the U.S. giants and a global-infrastructure provider, we can more clearly compare them with large exchanges worldwide (Japan, China, Europe, etc.), and with emerging-market exchanges.

🌍 Key Emerging-Market Stock Exchanges Worth Knowing

Below, exchanges are grouped by region, with concise notes on why they matter.

Asia (Ex-China “Big 3”)

(China’s SSE/SZSE/HKEX are technically not “emerging” in market size — they’re already global giants — so below focuses on other EMs.)

1. National Stock Exchange of India (NSE)

- Country: India

- Why it matters: Among the fastest-growing major markets globally; India is projected to become the world’s 3rd-largest economy.

- Specialty: Extremely high trading volume, strong tech/IT sector representation, deep derivatives market.

- Status: Often considered on the brink of full “developed market” classification.

2. Bombay Stock Exchange (BSE)

- Country: India

- Why it matters: One of the world’s oldest exchanges; huge number of listed companies (including many micro/small caps).

- Specialty: Breadth of listings — unmatched except by Japan and China.

3. Korea Exchange (KRX) (transitioning from EM toward developed)

- Country: South Korea

- Why it matters: Home of Samsung, Hyundai, LG; globally integrated, tech-heavy.

- Specialty: One of Asia’s most sophisticated financial markets.

4. Taiwan Stock Exchange (TWSE) (sometimes classified EM, sometimes developed)

- Country: Taiwan

- Why it matters: The heart of the global semiconductor supply chain (TSMC).

- Specialty: Investor exposure to world-critical electronics and chip manufacturing.

5. Indonesia Stock Exchange (IDX)

- Country: Indonesia

- Why it matters: Southeast Asia’s largest economy.

- Specialty: Resources, banking, digital-economy IPOs (e.g., Gojek).

- Status: Rapidly modernizing; high foreign-investor interest.

6. Stock Exchange of Thailand (SET)

- Country: Thailand

- Why it matters: Regional hub for tourism, manufacturing, and consumer sectors.

- Specialty: Stability and relatively mature regulation for an EM.

7. Bursa Malaysia

- Country: Malaysia

- Why it matters: Mid-sized but very stable; strong commodities exposure.

- Specialty: Major palm oil and natural resources listings.

8. Philippine Stock Exchange (PSE)

- Country: Philippines

- Why it matters: Fast-growing population and consumer economy.

- Specialty: Concentrated index dominated by conglomerates and banks.

🌍 Middle East (Rapidly Emerging & Transforming)

9. Tadawul (Saudi Stock Exchange – TASI)

- Country: Saudi Arabia

- Why it matters: By far the largest exchange in the Middle East.

- Specialty: ARAMCO (world’s largest IPO), massive sovereign-driven projects (Vision 2030).

- Status: Transitioning toward global integration.

10. Abu Dhabi Securities Exchange (ADX)

- Country: UAE

- Why it matters: One of the fastest-growing exchanges globally.

- Specialty: Energy + logistics + new fintech listings.

11. Dubai Financial Market (DFM)

- Country: UAE

- Why it matters: Financial hub for the MENA region.

- Specialty: Strong IPO pipeline and international investor access.

🌍 Africa (Frontier → Emerging Transition)

12. Johannesburg Stock Exchange (JSE)

- Country: South Africa

- Why it matters: Africa’s largest and most advanced market.

- Specialty: Deep mining, energy, industrials; strong regulatory framework.

- Status: Often treated as an EM anchor for the entire continent.

13. Nigerian Exchange Group (NGX)

- Country: Nigeria

- Why it matters: Africa’s largest population and rapidly growing fintech sector.

- Specialty: Banking, telecom, consumer goods (e.g., Dangote).

- Status: High-growth but volatile.

14. Nairobi Securities Exchange (NSE – Kenya)

- Country: Kenya

- Why it matters: East Africa’s financial gateway.

- Specialty: Strong regional banking and telecom (Safaricom).

15. Egyptian Exchange (EGX)

- Country: Egypt

- Why it matters: Large population, industrial base, and pivotal geopolitical role.

- Specialty: Mix of industrials, financials, and consumer sectors.

🌎 Latin America

16. B3 – Brasil Bolsa Balcão

- Country: Brazil

- Why it matters: Dominant exchange of South America.

- Specialty: Finance, mining, agriculture, energy; strong derivatives market.

- Status: Mature EM nearing developed classification.

17. Bolsa Mexicana de Valores (BMV)

- Country: Mexico

- Why it matters: North-American supply-chain integration; many global manufacturers.

- Specialty: Telecom, consumer staples, industrial conglomerates.

18. Santiago Stock Exchange

- Country: Chile

- Why it matters: Stable economy, major copper producer.

- Specialty: Commodities + banking.

19. Bolsa de Comercio de Buenos Aires (BCBA)

- Country: Argentina

- Why it matters: Large but volatile market.

- Specialty: Agriculture, banking, and energy.

Europe (Non-Western Emerging Mkts)

20. Warsaw Stock Exchange (WSE)

- Country: Poland

- Why it matters: Largest EM exchange in Europe.

- Specialty: Eastern Europe industrial, energy, and financial exposure.

- Status: Considered the “gateway exchange” to Central/Eastern Europe.

21. Istanbul Stock Exchange (Borsa Istanbul – BIST)

- Country: Türkiye

- Why it matters: Bridge between Europe and Asia.

- Specialty: Banks, industrials, transportation — high liquidity.

22. Bucharest Stock Exchange (BVB)

- Country: Romania

- Why it matters: Rapidly reforming market; increasing foreign inflows.

- Specialty: Energy firms and utilities.

🧭 Additional Emerging / Frontier Exchanges of Note

Small but strategically important:

- Vietnam (Ho Chi Minh Stock Exchange – HOSE) → One of the fastest-growing economies in Asia.

- Bangladesh (Dhaka Stock Exchange) → Large population; rising manufacturing base.

- Pakistan Stock Exchange (PSX) → Volatile but important in South Asia.

- Kazakhstan Stock Exchange (KASE) → Resource-rich, China-Russia corridor.

- Colombia (BVC) → Andean region exposure.

- Peru (BVL) → Copper & mining-driven.

These exchanges are not (yet) as large, but several are growing rapidly and are increasingly represented in EM ETFs and global indices.

📌 Patterns in Emerging-Market Exchanges

Most EM exchanges share common traits:

- More concentrated indices (banks, conglomerates, commodities).

- Higher volatility but higher long-term growth potential.

- Younger investor bases, rising retail participation.

- Strong linkage to demographics and industrialization trends.

- Exchange reforms often drive foreign investor access (India, Saudi Arabia, Vietnam, etc.).

References and Notes:

[1] Sizes of an exchange, for the purposes of this Friday Finance post, are calculated by examining the underlying offerings on the exchange and quantifying them each by Present Value or PV. The PV is calculated more precisely by taking the number of shares outstanding for each company and multiplying that number of shares by the closing price of the company stock. The resulting calculation is called the Market Capitalization of the company, market cap for short. While these values can vary from day to day (and minute by minute), there is a relatively stable measurement of what the company is worth at the end of each day. As an example: Apple (AAPL), as of the last public announcement (September, 2025), had around 14.8 billion shares outstanding. And the value of those shares at the close of Q3, 2025 was $254.38/share. By multiplying these two numbers, Apple stock was worth $3.76T (T for trillion, that’s with 12 zeros), and was one of the most valuable companies in the world. The same calculation goes for all of the publicly traded companies in that market. And the Market Size of the exchange equals the summation of all of the market caps (PV) of the companies that trade on that particular exchange.

[2] The Buttonwood Agreement was a pivotal pact signed on May 17, 1792, by 24 New York stockbrokers and merchants. The signing was conducted under a buttonwood tree on Wall Street, thereby establishing rules for orderly securities trading, agreeing to trade only amongst themselves, and setting a fixed commission rate, effectively serving as the foundational document for the New York Stock Exchange (NYSE). This agreement brought structure to the chaotic early U.S. financial markets, promoting trust and paving the way for organized capitalism.

Key Points of the Agreement:

- Date & Location: May 17, 1792, under a buttonwood tree (Sycamore) at 68 Wall Street, New York City, NY.

- Participants: 24 leading merchants and stockbrokers.

- Core Rules:

- To only trade securities with each other (creating an exclusive market).

- To charge a minimum commission of one-quarter percent (0.25% or 25 basis points floor) on transactions.

- To give preference to fellow members in their deals.

- Significance:

- Birth of the NYSE: It’s considered the place of origin of the NYSE, the exchange was formally chartered 25 years later in 1817.

- Market Order: Brought structure and credibility to the fledgling U.S. financial system.

- Foundation of Trust: Fostered public confidence by creating a regulated environment for trusted dealings between buyers and sellers in an open and dependable market.

The principles of the Buttonwood Agreement, though simple, created the framework for the modern American stock market, transforming chaotic trading into an organized institution.

[3] The origins of the London Stock Exchange (LSE) lie not in a single founding act, but in a gradual evolution of securities trading in London from informal coffeehouse meetings into a formal institution. It is one of the oldest trading institutions in the English speaking world.

Early trading roots (16th–17th centuries).

London’s role as a financial center expanded rapidly in the late 1500s and early 1600s with the growth of overseas trade, joint-stock companies, and government borrowing. Merchants and financiers began trading shares in ventures such as the Muscovy Company (1555) and later the East India Company (1600), as well as government debt instruments. These transactions were informal and took place in streets, taverns, and private offices.

Royal Exchange and exclusion of brokers (1571–1690s).

In 1571, Sir Thomas Gresham established the Royal Exchange as a dedicated space for merchants to conduct business. However, stockbrokers were widely regarded as unruly and speculative and were eventually excluded from the Royal Exchange in the late 17th century. This exclusion proved pivotal: brokers migrated to nearby coffeehouses, especially Jonathan’s Coffee House in Change Alley, which became the de facto center of securities trading.

Coffeehouse trading and early price lists (late 17th–18th centuries).

By the 1690s, Jonathan’s Coffee House was publishing early lists of stock and commodity prices, a crucial step toward standardized markets. Trading expanded rapidly following the Glorious Revolution of 1688, which strengthened parliamentary control over public finance and led to a surge in government bond issuance. The explosion of speculative activity during the South Sea Bubble of 1720 further underscored the need for more structured markets and rules.

Move toward formal organization (18th century).

Throughout the 1700s, brokers attempted several times to establish more formal trading arrangements. Many early efforts failed due to disputes over membership and governance. Nonetheless, the idea of a self-regulating body of brokers gradually took hold, emphasizing admission rules, codes of conduct, and dispute resolution.

Formal founding (1801).

In 1801, a group of brokers raised funds to build a dedicated exchange building in Capel Court, near the Bank of England. This marked the formal establishment of the London Stock Exchange as an institution with paid membership, written rules, and a physical trading floor. From this point forward, the LSE evolved into a central pillar of British and global finance.

19th–20th century development.

During the 19th century, the LSE grew alongside the British Empire, financing railways, canals, mines, and infrastructure projects across the world. It became the leading global capital market by the late 1800s. In the 20th century, the exchange modernized its governance and technology, culminating in the “Big Bang” reforms of 1986, which abolished fixed commissions and opened membership to foreign firms, transforming the LSE into a modern global exchange and international juggernaut.

In summary, the London Stock Exchange originated from informal trading among merchants and brokers in coffeehouses, was shaped by Britain’s expanding trade and public finance needs, and became formalized in 1801 as a regulated institution—one that later grew into one of the world’s most influential financial markets.