Friday Finance: Emergency Funds – how much is enough?

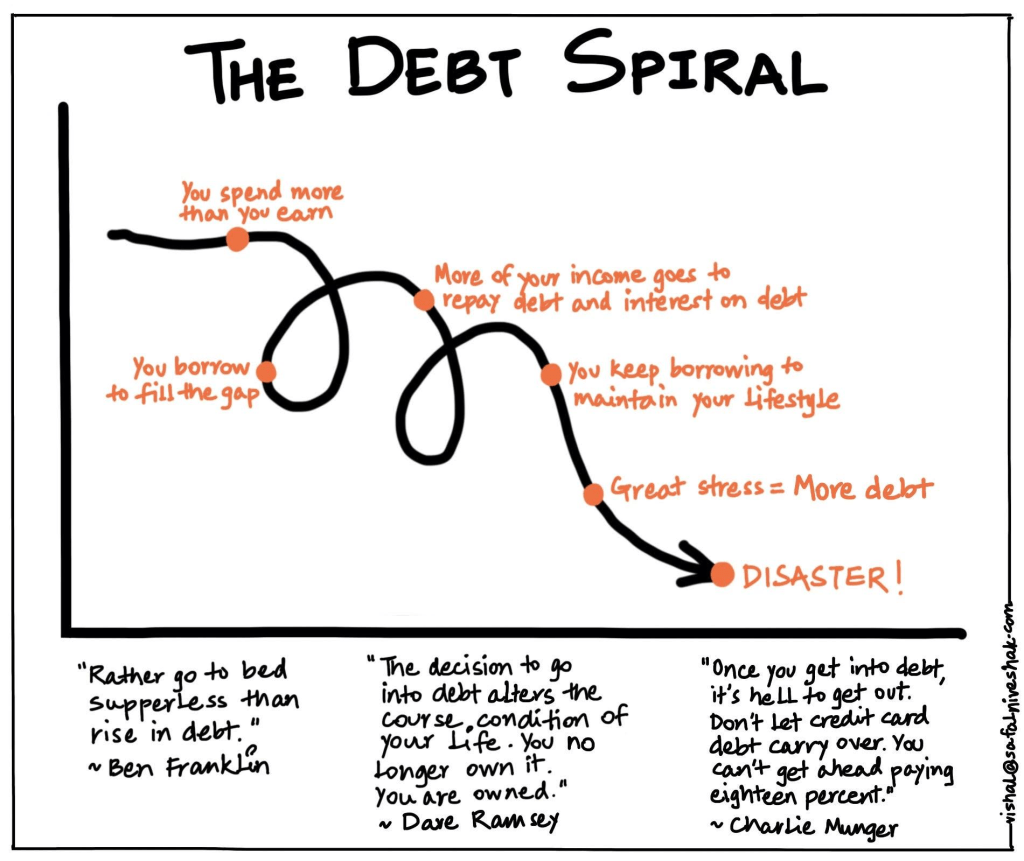

If there’s one financial safety net every adult needs, it’s an emergency fund. Why? Because life has a way of surprising us — layoffs, medical bills, car repairs, or a sudden move can knock us financially off course. Without a cushion, those surprises often turn into punishing debt. An emergency fund is your financial buffer; it’s a way to stay afloat when the unexpected happens.

So how much savings is enough for an emergency fund? A common rule of thumb is to build a fund large enough to cover at least three months of your expenses. That amount is designed to give you breathing room — time to pay essential bills, keep a roof over your head, and avoid panic decisions when life throws you a curveball.

But experience has taught us that three months might not always be enough. During the COVID-19 pandemic, for example, many financial planners doubled that recommendation to six months of expenses. Why? Because people learned the hard way that finding a new job or regaining financial stability can take longer than expected. A six-month cushion can mean the difference between weathering a storm and spiraling into debt.

If that number sounds intimidating, don’t let it stop you from starting. Most people don’t save their emergency fund all at once — they build it gradually over several years. Even setting aside a small amount from each paycheck — $25, $50, or $100 — will grow over time. The key is consistency. Think of it like training for a marathon: the first few miles feel tough, but once you build momentum, every step brings you closer to the finish line.

Here’s a simple plan:

- Start small and automate. Set up an automatic transfer into a dedicated savings account after every paycheck.

- Build your first milestone. Aim for one month’s worth of expenses first.

- Keep building the fund over time. Once you hit one month, stretch to two and three. When life allows, aim for six.

The peace of mind that comes with a fully funded emergency account is hard to overstate. It turns unexpected crises into manageable inconveniences — and that’s one of the most powerful forms of financial freedom you can give yourself.