Friday Finance: Mortgage

This week (November, 2025) in the finance world, the White House wants Americans’ gaze to be ushered away from the recent Government Shutdown and the pending Jeffrey Epstein messages. Instead we heard President Trump touting that he was helping out the American public by offering an extended mortgage for the new buyers. In lieu of the traditional 15 year or 30 year mortgages, he was calling for a 50 YEAR Mortgage. While this is not a new idea, it is a financial tactic that is deceiving. While the added 20 years certainly lowers the monthly payments that a potential homeowner would pay; it is key to note that the amount of total interest paid by the homeowner will balloon and far exceed the original cost of the house! The new buyer essentially becomes a 50 year rent payer to the banks, who in fact own the house.

So, What is a Mortgage Anyway?

A mortgage is a loan on residential real estate, i.e. primary or secondary residence, that is paid for over time, typically 15 – 30 years, at prevailing interest rates. The Word MORTGAGE is interesting, if you want to read about it’s original and newer meanings see this LINK.

Help Me Understand the Process and Costs

Assuming you are still ready to see what is out there in the new homeowner real estate world, here is a decision-checklist with your assumptions: purchase price = $1,000,000, 20% down payment ($200,000) → loan principal = $800,000. This example assumes that the loan options includes 1) current builder preferred prevailing interest rates, a 3.99% teaser rate (builder buydown), and 2) an historical “few years ago” rate for context. Below the checklist I have inserted payment/interest tables for the various term/interest-rate combinations so you can plug them in during your meeting.

ChatGPT did a nice job of building the following check lists and payment tables for easy comparison.

Decision Checklist (with $1MM home assumptions)

Bring this check list to the builder’s sales rep and fill it out together with them. Use the $1 million figure as a bench mark: if the house is more than that sum or less, insert the percentages of the rates and payments in your calculations.

1. Price & Market Reality (Questions to ask yourself and your realtor)

- Do you love the house? Can you see yourself living here for at least 7 years? If YES, proceed … If NO, stop and keep renting your primary residence.

- “What are the most recent ‘closed sales’ of comparable homes in this community?”

- “Can I see an independent appraisal or other evidence that $1,000,000 is justified for this property?”

- “Is the $1,000,000 price tag before or after builder incentives?”

2. Mortgage Rate Details (Especially for Builder Buydowns)

- “You’re advertising a 3.99% rate — is that a permanent rate or a temporary buydown?”

- If it’s a buydown:

- “How many years is the buydown active?”

- “What is the rate after the buydown ends?”

- “Who pays the buydown cost (builder, lender)? How much in dollars is it?”

- “What will the monthly payment be after the buydown expires?”

- “If we cannot refinance, what’s the long-term cost of the loan at the full rate?”

3. Loan Term Comparison (15- / 30- / 50-year mortgages)

- “Can you show me monthly payments and total interest paid (called amortization tables) for 15-year, 30-year and 50-year terms on the $800,000 loan?”

- “How quickly will I build equity under each term?”

- “If there’s a 50-year term, is the loan fully amortized or is there some interest-only period?”

4. Down Payment Options (Including Less Than 20% options)

- “What are our down payment options? e.g., 10%, 15%, 20%?”

- “What would the monthly payment be at each down payment level (including private mortgage insurance – PMI, taxes, insurance, HOA)?”

- “How much cash do I need at closing for those costs? And how much will be needed for each option (down payment + closing costs + buydown/incentive costs)?”

5. PMI (Private Mortgage Insurance) If Down Payment is <20%

- “If we invest less than 20% down payment at closing, how much will PMI cost us monthly?”

- “When and how can we get PMI removed (percentage of equity, appraisal, refinance)?”

- “Is there an upfront PMI fee or only month?

PMI: How Much Does it Cost? Private mortgage insurance premiums vary in amount, from a fraction of a percent to as much as 1.5% of the value of the original loan. (Please Note: @ 1.5% on an $800,000 loan, that is an additional $12,000/year.) PMI payments are paid monthly and the fees are collected each year, or until it is no longer required by the lender issuing your mortgage.

The Private Mortgage Insurance company collects from the borrower several key elements: A) state and federal taxes owed on the property at end of year, B) interest charges, 3) principal payments, and 4) PMI insurance fees. Each of the companies that is owed money for your house is paid out of that PMI Insurance, by the insurance company.

6. Total Monthly Payment Reality Check

Ask for a written breakdown of all of the monthly costs/charges that you as the buyer will incur including:

- Principal & interest

- PMI (if applicable)

- Property taxes

- Homeowners insurance

- HOA or community fees

- Any special assessments now or on the horizon

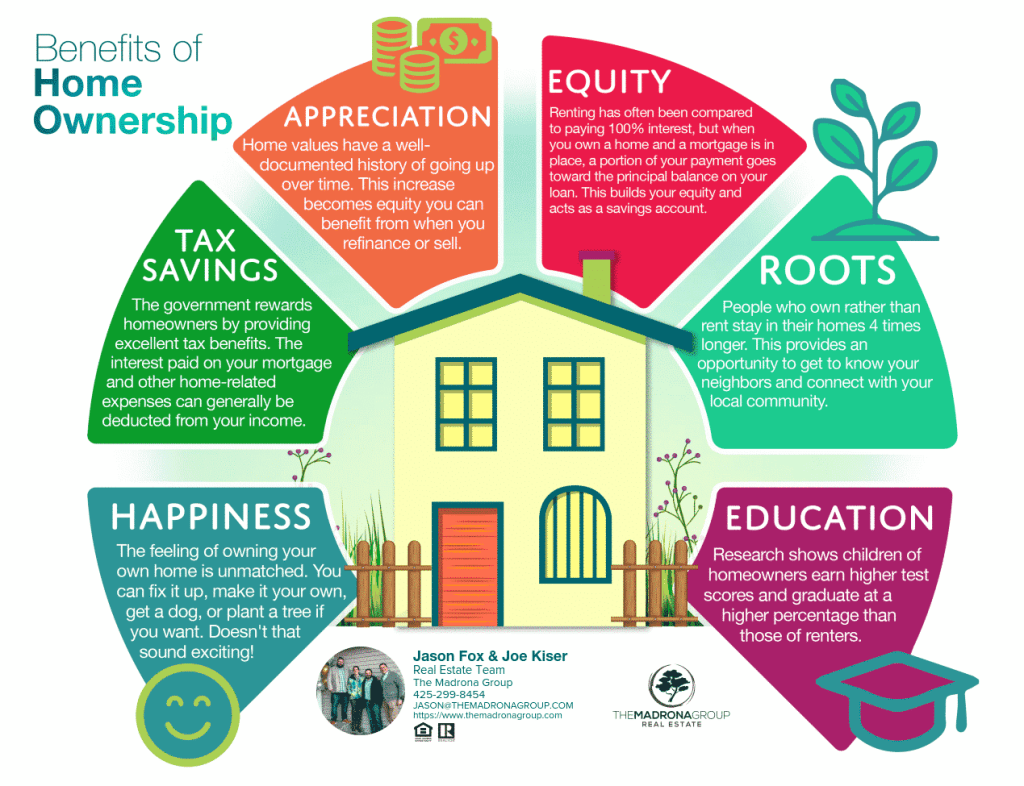

7. Equity-Building & Resale Risk

You build equity in two fundamental ways: 1) with your downpayment. Presumably you are paying market prices for your home and any money you put down, immediately goes toward your equity. 2) The second way to gain equity is through monthly payments of the mortgage. Each payment consists of interest and principal. Each principal portion of your payment adds to the value of your equity.

- “What are recent resale prices in this neighborhood for homes 2-5 years old?” If the realtor you have is doing her job, she will be able to give you as many comparison sales as you need to see how the market is doing in your new neighborhood or the whole city.

- “If home values flatten or drop, how much headroom do we have with this purchase?”

- “What equity might we expect after 5 years under each loan term?”

8. Incentives vs. Lower Price

- “You’re offering incentives (rate buydown, upgrade credits) — what is the dollar value of those?

- “What if instead we negotiated a lower price by that same amount — how would that compare?”

9. Flexibility & Refinance Options

- “Is there a prepayment penalty if we pay extra toward principal or refinance early?”

- “If we refinance within a few years, will we lose builder incentives or have any restrictions?”

10. Walk-Away Conditions (Your Safeguards)

Don’t proceed with the purchase unless each of the following conditions is met (and you understand them) to your satisfaction:

- Monthly payment fits your budget (including all ancillary costs)

- You fully understand the buydown, full rate, and what happens when it ends

- The home’s price is justified by comps and you are comfortable with possible resale risk

- If down <20%, PMI cost is acceptable and you have a plan for paying for it until you have the basis to get rid of it

- You have emergency savings after closing (3–6 months minimum expenses)

- You are okay with the total interest costs and you know how fast you will be building equity in the transaction

Payment & Total Interest Table (Loan = $800,000, which is the $1,000,000 home price minus 20% down) for 15/30/50 year terms

Here are sample numbers for three interest-rates. The 50 year rates and payments are in BOLD below:

- 3.99% (builder buydown / promotional)

- 5.49% (close to recent 15-yr average) FRED+2Bankrate+2

- 6.24% (recent 30-yr average) FRED+1

| Term | Interest Rate | Monthly Payment Approx* | Total Paid Over Life | Approx Total Interest |

| 15 years | 3.99% | ≈ $5,915 | ≈ $1,066,700 | ≈ $266,700 |

| 30 years | 3.99% | ≈ $3,814 | ≈ $1,372,960 | ≈ $572,960 |

| 50 years | 3.99% | ≈ $3,078 | ≈ $1,846,800 | ≈ $1,046,800 |

| 15 years | 5.49% | ≈ $6,545 | ≈ $1,180,100 | ≈ $380,100 |

| 30 years | 5.49% | ≈ $4,542 | ≈ $1,635,120 | ≈ $835,120 |

| 50 years | 5.49% | ≈ $3,913 | ≈ $2,348,000 | ≈ $1,548,000 |

| 15 years | 6.24% | ≈ $6,728 | ≈ $1,211,040 | ≈ $411,040 |

| 30 years | 6.24% | ≈ $5,004 | ≈ $1,801,440 | ≈ $1,001,440 |

| 50 years | 6.24% | ≈ $4,430 | ≈ $2,657,800 | ≈ $1,857,800 |

* Rounded values; assume full amortizing loan, excludes taxes/insurance/PMI.

Interpretation:

- The 50-year loan dramatically lowers the monthly payment compared to a 15-year but huge extra interest payments come into the picture. NOTE: Under the 50 years 5.49% rate, your interest payments will 1.94 times MORE than the $800,000 original loan.

- Even the 30-year mortgage at current rates means you’ll pay over $1 million in interest on a $800k loan, if you keep the property and pay for it full term.

- The teaser 3.99% interest rate helps a lot to lower your monthly payments, but if it’s temporary and later adjusts higher or if you effectively refinance your mortgage later at a higher interage rate, the benefits may vanish or reverse.

“A Few Years Ago” Rate for Context

If you go back a few years: in mid-2000s, average 30-year fixed was about 5.9% (2005) per historical data. Bankrate+1

At 5.9% on $800,000:

- 30-year monthly ~ $4,774 → total paid ~ $1,718,640 → interest ~ $918,640

This example shows how much worse even a small increase in your mortgage rate makes in your total interest payments over the long run.

How to Use This Information in Your Meeting with a Builder

- Fill out the monthly payment & interest slots for the actual rate the builder offers (if different).

- Ask the builder to show you payment tables for each term under their rate plus the full (post-promo) rate.

- Compare: monthly payment vs. total interest cost vs. building equity

- Decide: Do you love the house and are you financially comfortable with the monthly payment plan and the total interest costs?

- Use the “walk-away” conditions: if you don’t understand the buydown, or the price seems high vs comps, or the payment after promo is stretching your budget, walk away or renegotiate.

How can I be Smarter about my Mortgage?

- Buy down the monthely interest rate by paying points up to the amount you can afford when you establish your first mortgage.

- Invest in your house. The rule of thumb is to invest approximately 1% – 2% of the value each year putting that investment back into the house. Do not wait for problems to bite you, like a leaky roof, it will never get better. Take the list from your home inspector and break their recommendations into a plan for your house. Electrical, plumbing, roof, chimney, basement, kitchen, landscaping…there are all areas worthy of an upgrade to invest in your house. Your large investment needs the annual review of what you can do to keep it on an upward trajectory with the market in your area.

- Refinance your mortgage and the prevailing rates. Another rule of thumb, when the interest rates drop by 1% or more, it is worth the closing costs of refinancing to secure a new, lower rate mortgage.

- Pay your mortgage payments “every other week,” in lieu of two times a month or once a month. Why? Please Note: If you pay every other week, that makes for 26 payments, which matches how often most people are paid. Paying two times a month is 24 payments. The “every other week” regime gives you two extra payments per year. Designate those extra payments as going toward your PRINCIPAL ONLY. That payment plan speeds up your equity accumulation, and lowers the total amount of interest you pay in the long run.