Friday Finance: Gold

Gold, as a commodity, has risen into the stratosphere over the past year and predictions are that it will rise even further. Why are gold futures AND spot gold prices at all time highs? What does that rise signal to the rest of us who are not directly investing in this precious metal? Time to invest? OR, Look Out Below?

Let’s start at the beginning. Gold is a scarce and rare precious metal. It is a commodity that is categorized as a non-income producing asset, like wheat or orange juice. Yet because of its appreciation, it has been revered around the world since it was first mined, melted and traded. Wedding gifts of gold jewelry are a large part of the gold trade in countries like India. Historically banks and government treasuries have held gold reserves as a backstop to their currencies. The US protected its gold reserves in heavily guarded places like Fort Knox, Kentucky.

Bretton Woods Era

The USD for over 30 years was convertible at a fixed rate to gold (The Gold Standard Act, 1900-1930s). Then, internationally, during what is known as the Bretton Woods era [2](mid-1940s until 1971), the dollar was pegged to gold at $35/oz. Many other currencies at that time were pegged to the dollar. The convertibility of the dollar at a fixed rate ended in 1971, when Pres. Nixon suspended it. And by 1973 the exchange rates floated freely and gold-backing of the USD was essentially gone.[3]

Currencies that are not backed by hard assets, like gold, are considererd “fiat currencies.” The USD is a fiat currency, by definition. Since it is not backed by assets like gold, the value of the dollar is based on “the issuer’s credibility, government management of the economy, and public trust.” In the US we label that global trust as the full faith and credit of the United States. We pay our debts and do not default.[4]

For much of its history gold has been characterized as a “safe haven” for assets during hard financial times, such as recessions and depressions. People and countries invest in gold when they fear the future and do not want to put their money at risk in the other markets.

Gold surpassed $4,000 a troy ounce for the first time on October 7, 2025, which puts the run-up at a 50% boost this year in the gold futures and spot gold prices. AND it sprinted past $5,000 a troy ounce on January 26, 2026. What do these run-ups and sprints mean? For one, it signals we are witnessing an investor rush away from the USD and into alternative assets, at a time when the outlook for the US economy is of real concern to investors and countries around the world.

Gold prices, which gained 27% in 2024, were predicted to hit $4,900 per troy ounce by December 2026. Analysts at Goldman Sachs forecast, as central banks add to their holdings and more investors buy in, attracted by the rapid gains. The point of fact is that they missed the speed with which it would surpass $5,000 in three months and not in twelve months or more.[1]

The price of gold (and remember, this is “a commodity”) has surged this year more than it did during some of America’s steepest crises. The USD denominated spot gold prices now outpace the previous surges in prices during the last recession (2007-2009) and the Covid-19 Pandemic (2020-2023). Not since the inflationary shock of 1979 has gold catapulted so much higher in a single year, much less a single quarter.

How Did We Get Here?

What is interesting on the surface is that this time there have been no similar disruptions to the financial system; there has been no inflationary shock, no recession and no depression. Instead, fear has been setting off alarm-bells in other countries. Gold has skyrocketed higher due to anxiety that Trump’s policies are upending the postwar economic order that underpins the USD.[1]

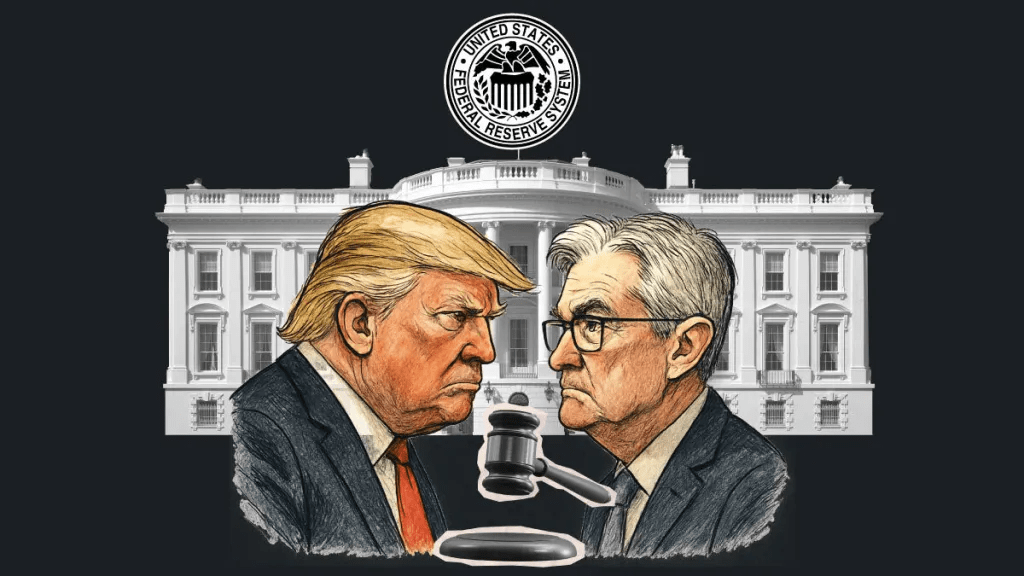

Trump’s attempt through tariffs to reorder global trade has buoyed prices and upended international growth forecasts. The USD, by one measure, has had its weakest first half of the year in more than five decades. And the relentless White House pressure on the Federal Reserve Chair Powell to lower interest rates is threatening the independence of the FED, which is seen around the world as one of the financial system’s critical bulwarks.[1]

Those factors elevated gold, perhaps the original refuge from market tumult, pushing actively traded futures past $3,000 a troy ounce in March, 2025 for the first time. But even as trade tensions have died down and AI-crazed stock markets have resumed their run in recent weeks, gold has notched record after record after record.[1]

The latest leg of the gold rally began in August, when FED Chair Powell signaled that the central bank would begin cutting interest rates. These cuts were deployed in an economy with low unemployment and above the 2% target for inflation.[1]

As the year 2025 has progressed, the US job market has weakened. That weakness normally drives down bond yields, with investors anticipating the FED’s cuts. Instead, the threat of lingering inflation and the fallout from global tariffs have combined to keep longer-term yields in a fairly narrow range. “That combination represents the perfect storm for gold,” said Aakash Doshi, head of gold strategy at State Street Investment Management.[1]

Central banks around the world, especially in countries that have strained relationships with the United States and “the West,” have been gobbling up gold for more than a decade, helping this prized precious metal surpass the Euro as the world’s second-largest reserve asset this year.[1]

Purchases picked up after the West sanctioned Russia over its 2022 invasion of Ukraine and some central banks moved away from dollar-based assets. Central banks bought 415 tons of gold in the first half of 2025, according to the World Gold Council, and many analysts expect continued central-bank purchases next year to support prices.[5]

Western investors have also piled into the market in recent months. September marked the biggest monthly inflows on record to US exchange-traded funds (ETFs) linked to physical gold, according to Morningstar Direct, with traders pouring about $33 billion into such funds.[1]

Stretching from Costco store aisles to underground vaults in London to the flickering screens of Wall Street, we are seeing a modern day gold rush. Greg Ip from the Wall Street Journal is dubbing this gold rush as a speculative frenzy, while The Street is calling it “the debasement trade.” The speculation has driven many Americans to run to the attic, find their grandmother’s gold heirlooms and sell off the jewelry to be melted down and traded for cash.[6]

Ken Griffin, CEO of Citadel, citing the steep drop in the USD this year said, “Sovereigns, central banks, individual investors around the world now say, ‘You know what? I now see gold as a safe harbor asset in a way that the dollar used to be viewed.'”[6]

At the same time, higher prices have been a boon to gold-mining companies that are suddenly in high demand. That demand has propelled some gold-mining stocks this year to trade higher than the stock market’s artificial-intelligence darlings. One ETF linked to mining companies has skyrocketed by nearly 100% over the past 12 months — more than double the gains of chip maker Nvidia.[1]

Some on Wall Street are beginning to warn that gold prices may be nearing a peak and are due for a correction. Bank of America analysts note that since the 1860s, gold’s multiyear-runs higher have consistently been followed by dramatic busts.[1]

Gold rallies tend to be long lasting, however. Before this year, in five of the past six years when gold futures rose by at least 20%, they rose again the following year, by an average of more than 15%, according to Citigroup. In any case, its feels like time to gird up our loins and to cover our assets.[1]

References:

[1] Uberti & Dezember, “Gold Prices Top $4,000 for First Time: Record run for futures comes amid concerns about the economy’s outlook,” Wall Street Journal, October 8, 2025; Written by David Uberti david.uberti@wsj.com and Ryan Dezember ryan.dezember@wsj.com

[2] The Bretton Woods Agreement (1944) established a new international monetary system to stabilize economies after World War II, creating the International Monetary Fund (IMF) and the International Bank for Reconstruction and Development (IBRD) to manage exchange rates, promote reconstruction, and foster economic development. The system fixed major currencies to the U.S. dollar, which was convertible to gold, but it collapsed in the early 1970s due to pressures from persistent U.S. balance-of-payments deficits and Nixon’s eventual 1971 suspension of dollar-to-gold convertibility.

[3] https://www.britannica.com/topic/Gold-Standard-Act

[4] The United States has a history of technical defaults and a potential for future ones, particularly when the impending debt ceiling approaches; however, it has never defaulted on the core debt obligation, such as interest payments or principal payments on bonds. While there have been instances of the government delaying or refusing to honor past promises on other forms of currency, these are distinct from a modern-day default on the national debt. A true default on the debt, which is the failure to pay bondholders, has never happened to the US. Many countries have defaulted on their debt throughout history and in recent times, including Argentina, Belarus, Brazil, Ghana, Greece, Lebanon, Russia, Spain, Sri Lanka, and Ukraine, among others. The specific nature and causes of these defaults vary, with some being due to economic collapse, others to conflict or political instability, and some to a combination of factors.

[5] China and Russia have been the most prominent gold buyers, especially in the last decade, alongside countries like Japan, Poland, India, and Turkey which have also significantly increased their gold reserves. These are largely central banks purchasing gold as a safe-haven asset during economic uncertainty and geopolitical instability. There is no widespread information identifying sovereign wealth funds as major buyers; the primary purchasers are national central banks.

[6] 10/09/2025: Greg Ip, WSJ article Gold is Hedge Against Central Banks, https://www.wsj.com/economy/central-banking/gold-price-central-bank