Friday Finance: Are You Credit Worthy?

When banks and other lenders evaluate you or your company, they are looking for a measure of your credit worthiness. Sounds simple enough. Just design a measuring stick that evaluates the likelihood of someone paying back the debt they owe in accordance with the loan requirements! As easy as that calculation sounds, this topic has been the cause of great consternation on Capitol Hill these days. Let’s explore why!

My FICO Score: What is it?

Back in 1956, two engineers from Stanford, William Fair and Earl Isaac, put up $400 each to start a company that could determine a credit rating for people looking to take out a mortgage, car loan, or credit card. Combining the two men’s last names the Fair Isaac Corporation was formed. Their scores, known as FICO Scores were a gamechanger for the banks and mortgage lenders of the day. The scores provided a quick and easy way to measure an individual client’s “creditworthiness.” And the three authorized credit rating agencies, Transunion, Experian, and Equifax, would collect those scores over time and use the information to generate a Credit Report on every consumer, who was looking for credit. And once a year, you could look at those Credit Reports, free of charge.

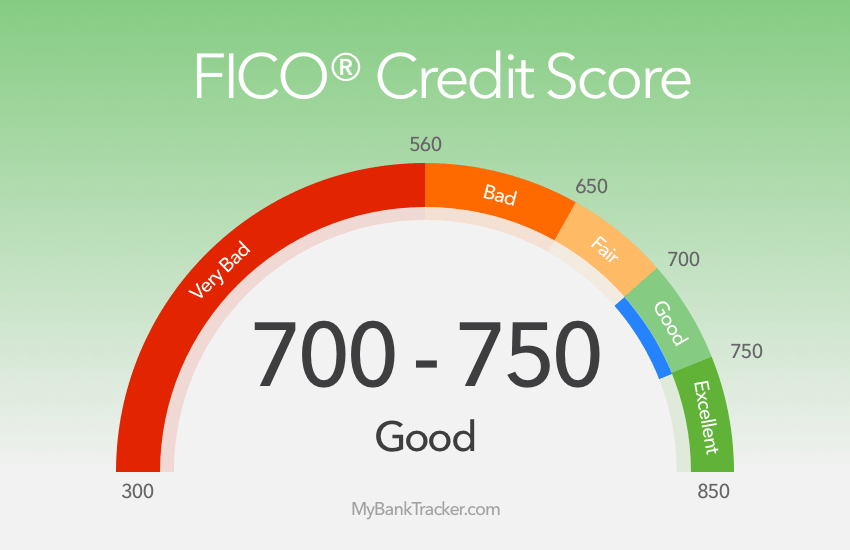

Fair Isaac Corp developed an evaluative score card that ranges from 300 to 850 points – the higher the score, the better the creditworthiness of the client. Why that range? We will have to ask the creators, but rest assured, they felt it is the ideal way to evaluate whether someone were a high or low risk creditor on any upcoming loan.

What are the Components of a Credit Score?

Each individual score is made up of five components: 1) payment history, 2) percent of credit limit available, 3) history wtih previous credit loans, 4) number of recent credit lines opened, and 5) how you handle various types of credit.

- 35% is based on your payment history. The most weight is given to whether you pay your bills on time.

- 30% is based on the amount you owe – the percentage of credit limits available.

- 15% is based on your length of credit, which is the amount of time a line of credit has been established.

- 10% is based on new credit accumulation – the number of credit inquiries and new line opening dates in the last 12-18 months.

- This is where “hard” and “soft” credit inquiries come into play.

- A hard inquiry occurs when a lender with whom you’ve applied for credit reviews your credit report as part of their decision-making process. This type of inquire appears on your credit report and can influence your credit score.

- A soft inquiry occurs when you check your own credit, or when a lender or credit card company checks your credit to pre-approve you for an offer. These do not impact your credit score.

- Too many hard inquiries in a short period of time can be concerning to lenders, because it could mean you opened multiple new accounts. But credit scoring models do consider the possibility that you are rate shopping for the best deal, so when there are multiple inquiries for a certain kind of credit product (like a used car loan!) in a short period, they will consider it to be a single inquiry, which will have a smaller impact on your credit score than multiple, separate inquiries.

- This is where “hard” and “soft” credit inquiries come into play.

- 10% is based on the type of credit, showing that you can responsibly handle a mix of credit. Installment loans (like auto, mortgage, and personal loans) raise scores, while revolving loans (like credit cards) tend to lower scores.

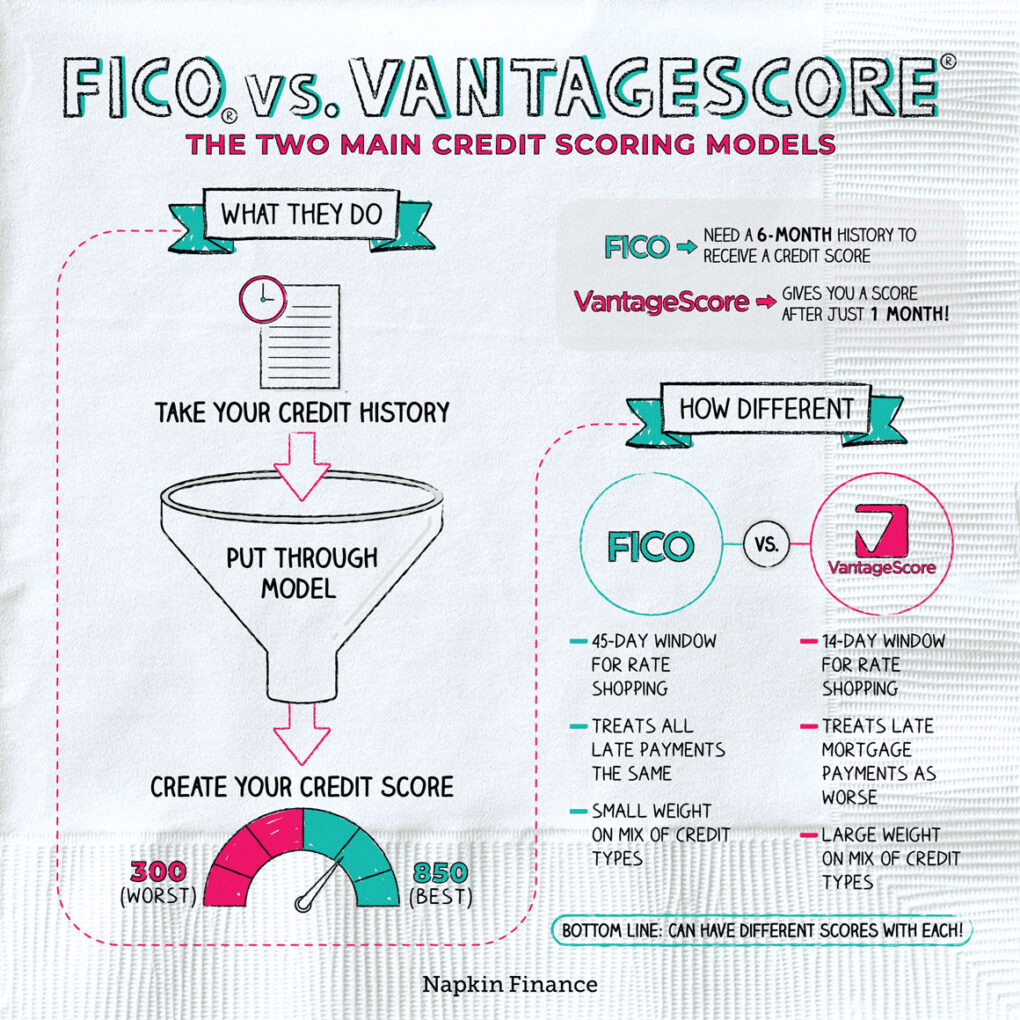

What is a VantageScore?

A new metric which is becoming more and more popular, is called VantageScore. It is a different way to evaluate the average consumer. The primary advantage of the VantageScore, over the classic FICO score evaluation model, is its ability to score more consumers, particularly those with a limited or “thin” credit file, by using alternative data and requiring less credit history.

The key benefits of VantageScore include:

- Greater Financial Inclusion: VantageScore can generate a score for consumers with as little as one month of credit history and one account reported within the previous 24 months. In contrast, classic FICO typically requires at least six months of credit history. This makes VantageScore more inclusive for younger borrowers, recent immigrants, or others new to credit.

- Use of Alternative Data: Newer VantageScore models (like 4.0) incorporate on-time rent, utility, and telecom payments into the calculation if they are reported to credit bureaus. This offers a more complete picture of a borrower’s financial responsibility beyond traditional credit accounts.

- Trended Data Analysis: VantageScore 4.0 leverages “trended data,” which looks at a consumer’s credit behavior over time (e.g., whether credit card balances are being paid in full or carried over), rather than just a snapshot at one point in time. This dynamic view provides deeper insights into financial habits.

- Consistency Across Bureaus: VantageScore was developed as a joint initiative by all three major credit bureaus (Experian, Equifax, and TransUnion), and its scoring logic provides a more uniform score across all three bureaus, which can reduce score variations for lenders.

- Enhanced Predictive Power Claims: VantageScore asserts that its models, particularly 4.0, offer superior predictive performance for mortgage defaults compared to the classic FICO score, allowing lenders to safely expand their approved borrower pool.

For consumers with a limited credit history, the VantageScore can be a significant advantage as it may allow them to get a credit score when a FICO score would not be available, potentially opening the door to loans or credit cards.

What is the Squabble between FICO and VantageScore?

The “squabble” between FICO and VantageScore, according to the Wall Street Journal (Nov. 1, 2025), has turned into an All-Out War! The head of the Federal Housing Finance Agency (FHFA), William Pulte, has accused FICO of monopolistic behavior. The FHFA has oversight of the quasi-governmental agencies, Freddie Mac and Fannie Mae. Agency head, Pulte, claims that FICO’s “anticompetitve actions are ripping off Americans … and they are using improper efforts to threaten regulators.”

This financial / political battle comes down to a commercial rivalry for market dominance in the credit scoring industry. VantageScore, which is a newer model that was developed by the three major credit bureaus (Equifax, Experian, and TransUnion) has become a direct competitor to the long-standing scoring method promulgated by FICO. VangageScore is vying for wider adoption by lenders, particularly in the lucrative mortgage market.

Key Points of FICO & VantageScore Contention:

- Market Share: FICO has historically been the industry standard, used by the vast majority of lenders for key decisions like mortgages, car loans and credit cards. VantageScore, established in 2006, is gaining ground, with its scores used in billions of transactions annually, but it still seeks more market share in order to displace FICO as the primary standard.

- Methodology and Inclusivity: VantageScore models are designed to be more inclusive, capable of generating a score with as little as one month of credit history and incorporating “alternative data” like rent and utility payments. FICO traditionally requires at least six months of credit history. VantageScore argues its methodology can accurately score millions more Americans, expanding access to credit.

- Predictive Accuracy Claims: Both companies publish white papers on their algorithms and point to independent studies (often with conflicting findings) that claim their model is more predictive of loan defaults than the other.

- VantageScore’s Position: VantageScore asserts its newer models (like VantageScore 4.0) are superior, especially in predicting mortgage defaults and identifying high-risk borrowers, by using modern techniques like “trended data” (analyzing credit behavior over time, rather than a single snapshot).

- FICO’s Position (and counterarguments): FICO and other analyses argue that once the inconsistencies in methodology are corrected, FICO performs as well as or better than VantageScore, and that VantageScore’s claims of superior performance are often an artifact of biased analysis.

- Regulatory Changes: A major development in the “squabble” involves the Federal Housing Finance Agency decision to allow Fannie Mae and Freddie Mac to use VantageScore 4.0 in addition to Classic FICO for mortgages. This opens up the possibility for VantageScore to gain a significant foothold in the mortgage market, which was previously almost exclusively FICO’s domain.

- Scoring Differences: While both scores use a 300-850 range, they weigh specific factors differently (e.g., FICO gives higher weight to credit utilization than VantageScore, and they have different grace periods for multiple hard inquiries). This means a consumer’s score from one model can differ significantly from the other.

Essentially, the “squabble” is a competitive battle between two different, proprietary credit scoring systems for market share, driven by differences in their underlying formulas, their claims of accuracy, and regulatory decisions that can open or close access to major lending sectors.

What Do All of the “Scoring” Algorithms Mean to Me?

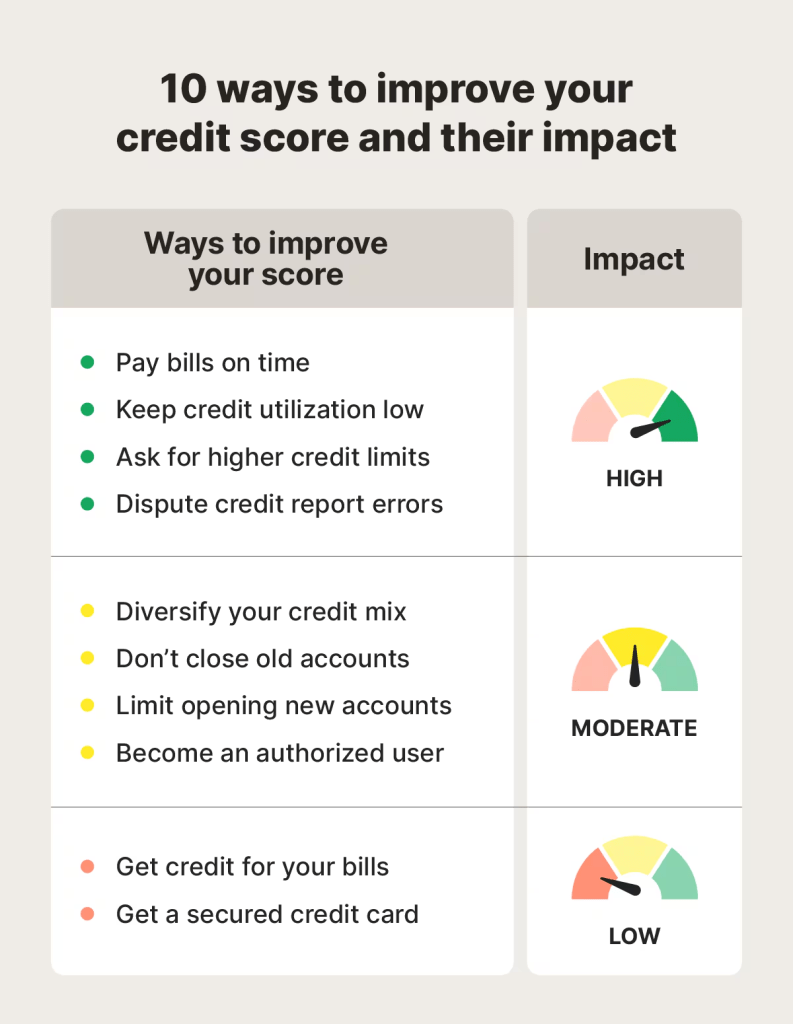

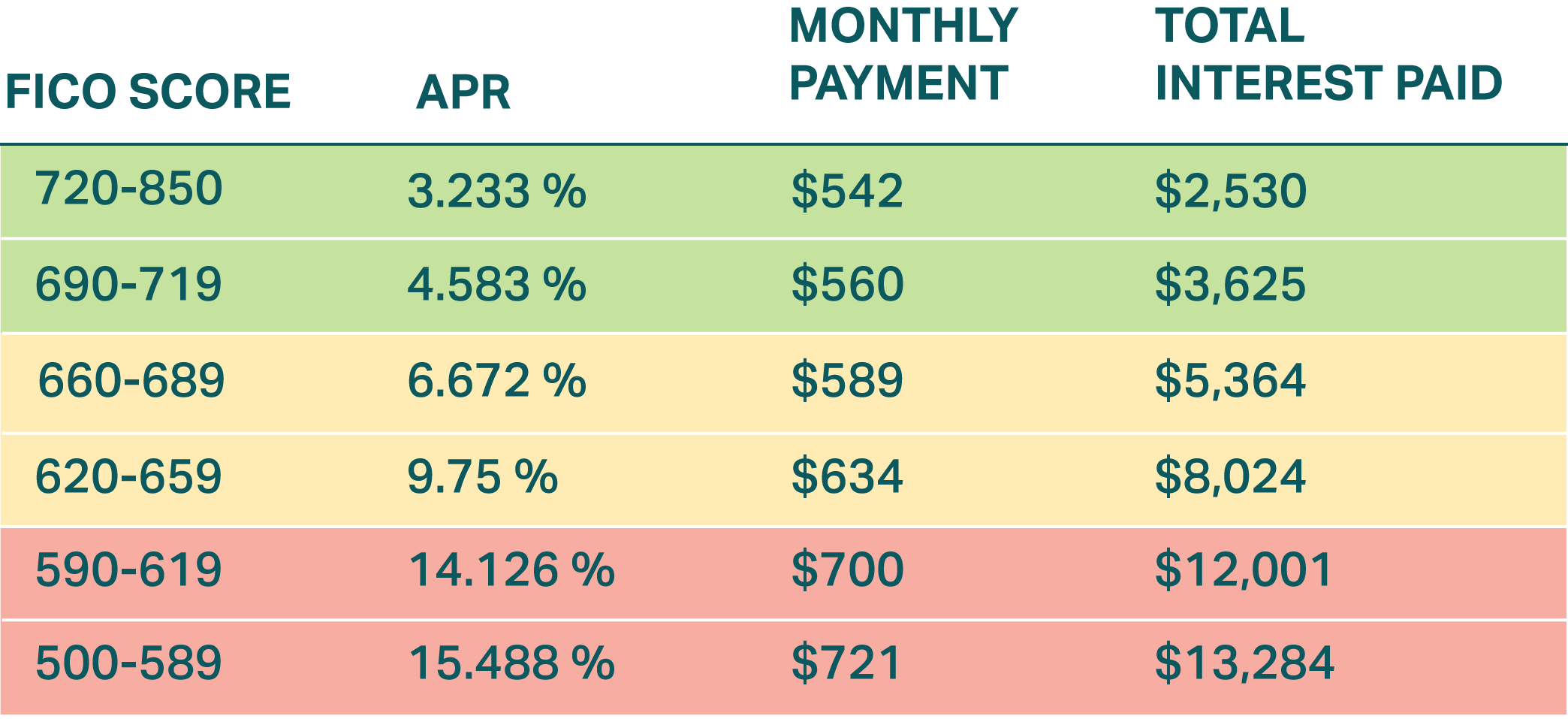

The bottomline truth is that the higher your credit score, the lower the interest rate you will be charged on the upcoming loan(s). And improving your credit score, once it is locked and set in motion, can take months and months of repair work. Any corrections for errors you find in your track record have to be scrubbed from the records for all three of the rating agencies, which can take a lot of time and energy. Even in the case of identity theft or fraud, the onus is on the consumer to make the claims and request changes. And even then, some credit issues, such as bankruptcy and incarceration, are extraordinarily difficult to remove. (Bankruptcy, for example under Chapters 7, 11 and 12, takes from seven to ten years to exponge from your records.)

In the example above, those individuals with a credit score lower than 500 cannot secure a car loan at all. And those with the highest credit score pay monthly amounts that are $179 less than those with the lowest score. That $179/month adds up to $10,740 more in interest over the five years of the loan, than those with a score of 720 or higher.

Many savvy consumers keep a watchful eye on their credit scores, in order to know what they will likely pay in monthly installments, including interest, for the goods and services that apply. They pay CASH whenever possible. And, if you need a loan, it is always helpful to know how to forecast your own creditworthiness and the monthly cash flow you need to pay for your purchases.

What are the expenses coming up in your life for which you want credit? New home, new/used car, next family vacation??? Nothing like having reduced interest rates, increased access to credit, and higher loan limits to put your financial mind at ease!